Current Scenario:

The depreciation of the Rupee is at an all-time low of Rs. 80 against the dollar and has provoked a lot of discussions, criticisms, and comparisons with past year’s crisis like the 2013 plunge in the economy. The value of the rupee has depreciated from Rs.17 per dollar (1990) to Rs.79.97 per dollar (2022), approx 25percent in the last eight years alone, and is expected to deteriorate further. Nearly 7.4 percent decline in Rupee, led the Reserve Bank of India to sell off foreign exchange reserves by nearly $40.94 billion since February, to stabilize the currency against the greenback. Inflation and predictions regarding further downfall due to Foreign Institutional Investors (FII) sell-offs and volatile global scenarios are also in the cards for India. But is the depreciation something to be worried about? Or is it just a temporary bump on the way to growth haven? Let’s observe the multifaceted truth around the arguments on the downfall of the economy.

Introduction:

Pre-independence, 1 INR was equivalent to 4 USD. Reasoning often used is; that because India was dominated by the British before 1947, the INR was worth more because the pound was worth more. Hence, it is assumed that in 1947, 1 Pound was equivalent to 13.37 Rupees; hence, the USD value should have been 4.16 INR.

However, India has consistently sustained a negative balance of payments deficit since the 1950s, despite efforts by the government to achieve a positive trade balance. Lack of government stability after Jawaharlal Nehru’s death and wars against our neighboring countries were some of the contributing factors that led to the devaluation of the Indian rupee. The two major incidents that shaped the value of the Indian rupee were the 1966 economic crisis and the 1991 devaluation. India’s trade imbalances have persisted since 1950 and worsened in the 1960s. The Indian rupee was devalued under the governance of Ms. Indira Gandhi on June 6, 1966, by 57 percent. It went from Rs 4.76 to Rs 7.50 a dollar, triggering bitter criticism in the Parliament and media. It was expected for a developing country like India to import more than it sells. Economists generally concur that by 1966, inflation had driven Indian prices, much above global prices at the pre-devaluation exchange rate.

In addition, the Indian government faced a budget deficit issue and could not borrow money from abroad or the private corporate sector because of the latter’s low savings rate. To enhance the money supply, the government issued bonds to the RBI. Inflation also caused Indian prices to increase higher, and the exchange rate simply became high. 13.9 percent was the maximum inflation recorded for the year 1966-67. One can say inflation started in 1966 and kept on increasing. The total inflation recorded in 1974-75 at 25.2 percent was mainly attributed to the failure of Kharif crops in 1972-73 and crude oil prices in 1973.

Determination of the Value of Rupee (past and present)

The currency value of any country, like any commodity, is determined by the intersection of demand and supply. No single institution is responsible for setting the value of a currency against the Dollar. It’s an ambiguous process determined by a combination of market factors, which is the case with the Rupee. But it was different earlier, that is, instead of the floating exchange rate system (followed presently), a fixed exchange rate was maintained by the RBI.

From the 1950s to the 1990s (Pre-liberalization era): The fixed exchange rate system was followed by India for the most prolonged period. Under this system, the Indian rupee was pegged to the value of internationally stable currencies. It was maintained by the intervention of the RBI and government using monetary and fiscal instruments. The fixed exchange rate ensured the pegging of money in a predetermined ratio for other currencies or gold or any other commodity.

1944: The Bretton Woods agreement was passed in 1944 when the history of the devaluation of the Indian rupee essentially began. By this agreement, the U.S. dollar was tied to the value of other currencies under the Bretton Woods System, which used gold as its foundation. The system was operational till 1971 after which a series of fixed exchange rate regimes were implemented.

1947: The “par value system” was followed under which the value of the rupee was determined against the UK pound sterling and Gold. It was responsible for the devaluation of around 36 percent Indian currency.

1971: Indian currency was pegged with the US dollar from 1971-1991 to the Pound from 1971-75.

1991-93: The Liberalized Exchange Rate Management system (LERMS) was introduced in which dual exchange policy is followed.

40 percent of the exchange rate was converted at the official exchange rate (used for necessary imports like crude, oil, fertilizer, medical drugs, etc) and the remaining 60 percent was converted at the market-based exchange rate (rest of the imported goods).

1993 – Present: Finally the floating exchange rate system was adopted. After the 1994 budget announcement, the 60:40 ratio was removed and the complete 100 percent market-based rate was maintained.

India finally adopted the market-based exchange rate where the intersection of demand and supply of the currency would determine the value of the rupee in the forex market. This system was a part of the Liberalization scheme (1990), though RBI carefully observed and timely intervened to buy and sell USD forex reserves in favor of the domestic currency. Although the only time the Indian currency was truly flexible, i.e. without any intervention, was from “2008-2013” when INR faced global pressure for depreciation of the currency.

Inflation & Exchange Rate:

The RBI uses the Repo rate to manage inflation in the economy. The repo rate refers to the interest rate at which the RBI loans money to commercial banks in the case of a funding gap. An economy with higher interest rates tends to attract more foreign investment, raising the demand for and value of the domestic currency. Similarly, lower interest rates decrease exchange rates. Suppose the repo rate is low in other markets. In that case, RBI may raise it, increasing interest rates, bond yields, and the return on debt securities, luring additional investment capital to seek higher returns. On the other hand, higher interest rates restrict the flow of money through the economy, leaving the RBI with more money to control the demand-supply situation. Additionally, as a currency’s value declines, imported items cost more, increasing inflation. As the reserve bank increases the interest rate, the demand for such commodities decreases due to rising prices. In contrast, a weak rupee is viewed favorably for exports, as foreign consumers can purchase its goods for less money. This is one of the reasons why countries that rely heavily on exports like to maintain the exchange rate low. When the exchange rate is fixed and a nation has significant inflation compared to other countries, domestic goods increase in price while imports decrease in price. As a result, inflation resulted in more imports and lower exports. It goes without saying that inflation impacts the lives of citizens in various ways. We experience a hike in everything- starting from basic food prices, fuel prices, interest on your loans, etc. This causes a major problem for a lot of citizens as wages do not increase as opposed to the increasing price of products.

Recent data suggests that the inflation rate ruling above 7 percent which is higher than the tolerance limit of 6 percent has resulted in the hike of interest rates set by the RBI. This might also affect the expected fall in Wholesale (WPI) and Retail (RPI) inflation.

Cause and Effect of Rupee depreciation (chain of events from the 2000s)

2004: Under Atal Bihari Vajpayee, the Indian foreign exchange reserves thrived, with minimum outflows and string inflows. The external debt was $112 billion in 2004 and was completely covered by the foreign exchange reserves. Speculations on money by arbitrageurs and high imports were the key reasons for the depreciation here.

2008: The year when the Global Economic Crisis took a toll on wall street, leaving behind traces of crippling economic crises around the world. In the aftermath of the GEC, the Indian government’s vision ignored long-term financial instability, Balance of payments and trade deficits, inflation, and forced growth alone. The RBI cut down the policy interest rates from 7% to as low as 3.25%, bond yieldings dropping down to 5% by the end of 2008. Furthermore, the government increased the fiscal deficit from 2.5% of GDP in FY08 to 6.5% in FY10 which is basically pumping money into the economy to induce demand and output which also brought back portfolio investments in the country and appreciating the currency to as low as Rs.44 by mid-2011.

2012: “Real crisis came in 2012-14 and not 2008-09”, said economists and experts as the Rupee touched the 60 mark by mid-2013. Within a decade the foreign debt tripled to $390billion and forex was as low as $292 billion. Constant depletion of the Current account deficit (CAD), imperfect supply chains in the market (missing coal fiasco, restraint on mining of iron ore), anti-investment measures, and environmental regulation tightening (2010) were some of the reasons behind the Rupee slump or post-GEC effects. Additionally, in 2011 the world also dealt with the “European sovereign debt crisis”.

2018: While the 2008 crisis had its epicenter around the wall street crash, the 2018 crisis was a failure to meet the demands of emerging markets. India was labeled the worst performer (Currency wise) in Asia with a 12 percent Rupee depreciation. Causes of the same include, a steep rise in the prices of crude oil, iron, Refined oils, and pulses which increased the trade deficit by 42% in 2017-18, to $160 billion. Oil supplies are funded via short-term debts and external debts which are required to be paid off within a year, which was another factor in the downfall. Following the high volatility in the currency, investors dumped the domestic currency and foreign investment outflows boomed, adding to the further depreciation of the currency, touching the 75 mark on 11 October 2018.

2022: After a two-year-long pandemic, an international war, volatile global financial conditions, and skyrocketing crude oil prices, the rupee is touching the Rs 80 mark this year in August. Although the rupee fell against the dollar, it has strengthened against the British pound, yen, euro, and other currencies, unlike the previous years. A Spike in the prices of crude oil has created a burden on foreign reserves and is countered to be one of the primary reasons for the currency depreciation.

The Lockdown of China is affecting the sentiments of emerging market currencies; Increasing world financial instability due to the Ukraine-Russia war and the drastic rise in Consumer Price Index (CPI) and Wholesale Price Index (WPI) depicting the soaring inflation rate have played a significant role in depreciation of domestic currencies against USD for emerging markets like India.

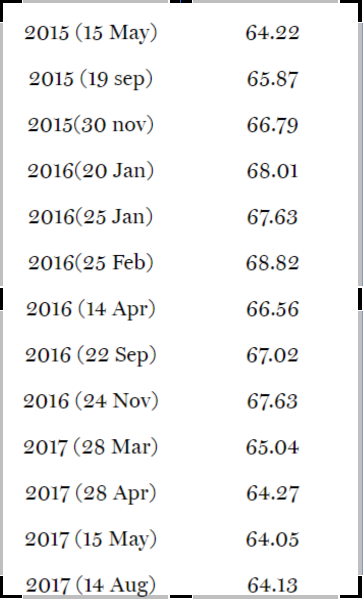

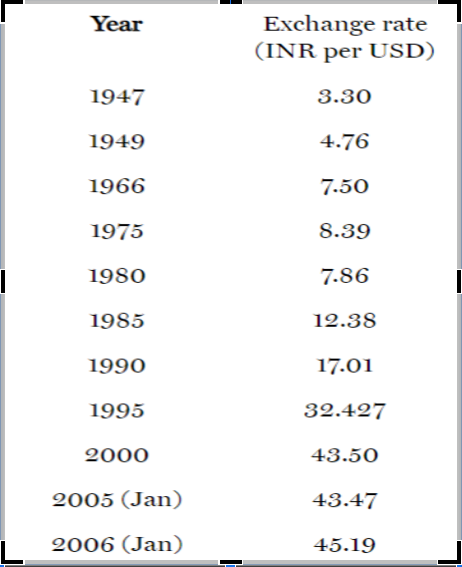

The following table shows the movement of the rupee value against the dollar over the years

(https://blog.thomascook.in/1-usd-to-inr-from-1947-to-2020/0) –

Recent Politics around “Rupee Downfall”:

Constant attacks on Prime Minister Narendra Modi and his party by the opposition party are being made, claiming him to be “harmful to the rupee”. The rupee’s performance was strong throughout 2017, outperforming 95 different currencies. But as INR fell against 134 currencies, 40 more currencies advanced during the Modi-led NDA administration, making the Indian currency one of the worst-performing currencies in the world in 2018. The Indian rupee (INR) lost ground to the currencies of Pakistan, the Maldives, Nepal, and Bangladesh while gaining strength over those of Sri Lanka and Afghanistan. The Indian rupee, also recognized in Bhutan, is equivalent in value to the Bhutanese Ngultrum. The most significant blow to the Indian Rupee during the Modi regime was demonetization. The two high-value notes of 500 and 1000 made up 86.4 percent of the cash in circulation when the demonetization was announced in 2016 with the primary goal of reducing black money. This is because people frequently hoard more valuable currencies. Though the government may have been able to stop the parallel black economy to a minor extent, the value of the Indian rupee increased from 67 to 71 in the following years.

There’s also a “fair” share of political games behind these attacks by the opposition government. Under Congress rule, India underwent a similar crisis in 2013 but that was accompanied by a double-digit inflation rate and a sharper impact on Foreign exchange reserves ($238,2013; $415,2018), crude oil prices at $107 per barrel, FD (4.8% of GDP,2013; 3.5% of GDP), etc. And the situation got worse with the policies that followed to handle these consequences. While BJP claims to stick with the strategy of moderate interventions, it still has a couple of challenges that would take the stand in front of the opposition. First, as elections are approaching, a demand push in the economy is preferred given that inflation has already decreased the real purchasing power of the people. Second, a hunt for black money to balance out the money supply of the economy.

Additionally, the decision of the Indian government to import crude oil from Russia amid the boycott the country faced during the Ukraine-Russian war saved Rs. 35,000 crores of the forex reserves. The proposal for international trade in Rupee as the medium currency has benefited countries like India in maintaining their dollar balance in the forex reserves.

Fact Check: Boon or a Bane?

The intervention by RBI this year to control the volatility of rupee fluctuations has led to forex depletion by $20 billion (biggest sale) in March 2022. There’s about $200 billion external debt redemption scheduled by the end of this year and hence the downfall might stir up challenges but it’s not the end of the world.

“We are there in the market almost on a day-to-day basis and our approach or our intervention in the market is broadly premised on two basic principles. One is to prevent excessive volatility of the Indian rupee that is the exchange rate; The second point is that it is also to build around the theme of anchoring expectations around the depreciation of the rupee. So, it is to prevent excessive volatility and to anchor expectations around the depreciation of the Indian rupee.” RBI governor Shaktikanta Das stated his stance.

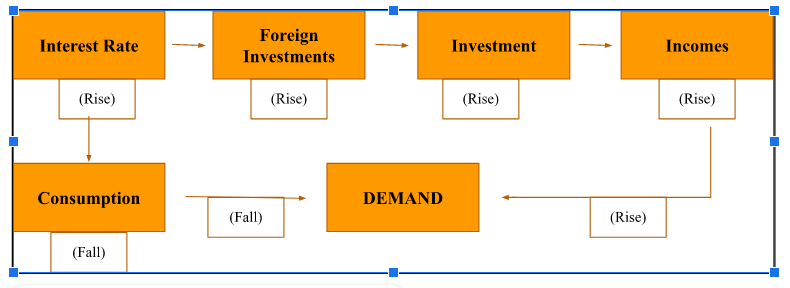

The one outcome of this downfall of the rupee which impacts the economy in a gruesome manner is Imported inflation, ie. Higher import prices of oils, necessities, and edibles, in turn, feed the price spiral theory. While other outcomes are corroborated with more efficient and sufficient economic growth. Which could be understood via the chart given below.

An increase in interest as a measure to deal with inflationary prices, slumps consumption, investment, and demands. While simultaneously attracting foreign investment inflows and making asset investment seem more lucrative. As a result, incomes also rise which in turn swells the demand. Demand for consumables increases and with the balance of investment and import substitution, the economy accelerates towards an efficient and competitive pathway of growth.

A crashing market, failed investments, and a surge in taxes are some of the more severe reasons to worry about in an economy. Adroit moves of government and central bank are enough to manage the bumps like depreciation as they could be a blessed turnaround and boon for the economic development.

Moreover, some of the positive impacts of the depreciation of domestic currency for India include, (1) The IT Sector boom: Being an export-centric sector, any downfall in domestic currency would boost exports and in turn make the global goals much more achievable. Outsourcing of part or complete business operations during covid also led to a spike in profits of IT companies. (2) Real estate sector: There’s a hike observed in the purchase of premium and luxury housing segments by the foreign investors and NRI with the downfall in Rupee value. (3) Metal stocks: India is a top producer of the crude steel industry in the world and is also a highly export-oriented industry. These industries and their stocks have witnessed a drastic hike with the rise in dollar value.

The Reserve Bank of India:

The Reserve Bank of India arbitrates in the market to support the rupee and has taken a chain of steps to get the situation under control as a weak domestic currency can raise a nation’s import costs. Last month, the RBI raised the limits of overseas borrowings for global companies and also liberalized norms for foreign investments as a measure to boost forex imports. There has also been deregulation of interest rates on investments by NRIs and foreign investors, to trigger the rise in demand for the Rupee which in turn will help with the appreciation of the currency. RBI has also increased the external commercial borrowing (ECB) limit under the automatic route from $750 million to $1.5 billion.

Way Forward:

During the Covid lockout between 2020 and 2021, India saw many job losses and a drop in average household income, and GDP growth was consistently declining. In March 2018, GDP growth was 8.2%, but by March 2020, it had slowed to 3.1%. During FY 2021–22, India’s merchandise exports rocketed to a new high of $417.81 billion, exceeding the government’s goal of $400 billion. This was primarily a result of MSMEs’ entrepreneurial initiatives. There are about 6.3 crore MSMEs in India, and they produce about 48 percent of all the nation’s exports and account for about 29 percent of the GDP. Through their domestic and international commerce, they are also responsible for one-third of India’s manufacturing output.

Moving forward, the decision to settle international trade transactions in Rupee has been taken (especially with crude oil trade with Russia, which will be beneficial to both countries) and given a green flag by the RBI. For doing so an opening of a Vostro account would be required to settle the import or export payments in INR. A Vostro account is an account that a correspondent bank holds on behalf of another bank for the partner country for transaction purposes— for example, the HSBC Vostro account is held by SBI in India.

Conclusion:

Hence, to conclude with the topic we could say that even though the current state of Indian rupee depreciation isn’t ideal for the short run, continuous measures are being taken on the institutional front. The negative impacts on inflation and FII can’t be ignored but so do the positive impacts on imports and overall growth of the economy in the long run. Political roleplay and unnecessary chaos around the depreciation of the rupee should be avoided at all costs and people should focus on factual truths around the news. Continuous efforts are made by the Central Government and the Central Bank of India to improve the strength of the currency.Also, India is expected to grow by 7 percent or more in FY2022 while the US might go under a mild recession with stagnant growth in mid- FY2023. While Rupee vs Dollar is a topic around the country, the stability of the Rupee has been persistent as compared to other currencies like Euro, Yen, Pounds, etc. From Rs 82 against a euro (2013) to Rs 81 (present), stable and stronger.

REFERENCE LINKS:

https://blog.finology.in/economy/rupee-depreciation

https://www.etmoney.com/blog/rupee-at-all-time-low-reasons-for-rupee-depreciation-and-its-impact-on-your-finances/

https://www.extravelmoney.com/blog/how-are-foreign-exchange-rates-in-india-determined/

https://www.businesstoday.in/magazine/cover-story/story/rupee-dollar-value-drop-factors-for-fall-28702-2012-02-24

https://bit.ly/3R4nYZg

https://bit.ly/3Q6XBki

https://bit.ly/3TxdTpj

https://www.thequint.com/voices/opinion/indias-80-phobia-why-a-falling-rupee-is-not-the-end-of-the-world

https://indianexpress.com/article/explained/explained-economics/rupee-international-trade-govt-push-explained-8136719/

📌Analysis of Bills and Acts

📌 Summary of Reports from Government Agencies

📌 Analysis of Election Manifestos