Abstract

Taxes are the means through which the government of a state renders its expenditures. Thus, it becomes the responsibility of the citizens of any state to pay their taxes on time. Tax is basically the contribution you make towards the growth and development of your country. Any administration of a state is always looking out for ways to increase tax compliance and strive towards improvement of the system. In India, with such a wide and dense population, different socio-economic backgrounds pose a challenge with respect to adherence to tax laws. The NDA regime has introduced many drastic reforms since gaining power in 2014. These reforms include GST, scrapping of wealth tax, reducing corporate tax rates, new income tax regimes among others. This paper offers a critique to the various types of taxation policies in India. It attempts to offer suggestions through prior literature and models of other countries.

Keywords: Tax, taxation, revenue

Taxes are levied through two major ways: deduction in incomes, and adding to the prices of goods and services purchased or rendered. Every tax in India has a constitutional and legal backing.

The Indian tax structure is broadly divided into two kinds of taxes – direct and indirect.

Direct taxes are levied directly on individuals and institutions and collected directly by the government. Examples are corporate tax, income tax, wealth tax, etc.

Indirect taxes are levied through sellers and retailers of various goods and services who ultimately shift it to the customer.

Some of the prevailing Indirect taxes are

- Basic Customs Duty Tax

- Exports Duty

- Road and Passenger tax

- Property Tax

- Stamp Duty

- Electrical duty

- GST

Goods and Services Tax (GST)

Goods and Services Tax is an indirect tax which was introduced to replace a host of other indirect taxes such as Value Added Tax (VAT), service tax, purchase tax, excise duty etc. GST is the one single tax which is levied on all goods and services in India.

Implementation of GST has a long history in India.

- The GST was first drafted by the committee in 2000 by the then Prime Minister of India (Late Atal Bihari Vajpayee).

- In 2004 the task force arrived to a conclusion that to enhance the tax regime in India , a new tax structure i.e. GST should be implemented.

- The introduction of GST was proposed by the then Finance minister of India in 2006 from 1st April 2010.

- The Constitution Amendment Bill enabled the introduction of GST law in 2011.

- In 2012, The Standard Committee tabled a report on GST.

- Again in 2014, the bill was reintroduced in the parliament by The Then Finance Minister of India (Late Shri Arun Jaitley).

- The bill was finally passed in the Lok Sabha in 2015 but rejection of the bill by the Rajya Sabha delayed its implementation.

- Both houses of the parliament passed the bill in 2016 with the amended model of GST. The President of India also gave assent but this was not enough.

- Again in 2017 , The four supplementary bills of GST were to be passed by both Upper and Lower houses of the parliament.

Finally the assent of the bill by both the houses, GST came into effect in India on 1st July 2017.

Critical Review of GST in India

Implemented and introduced under the headline ‘one nation, one tax’ but there are different levels of differentiation in the way the various sectors and industries in the economy have been impacted. The level of differentiation depends upon the type of industry such as Primary, Secondary or Tertiary.

GST has proved to be a boosting tool for increasing performance thereby increasing the competition of the Secondary Sector (Manufacturing Sector). Compliance burden has decreased in the sector with implementation of GST as compared earlier where there were multiple taxes which also led to an increase in additional costs.

One of the major benefits which the government has experienced is the reduced tax evasion by implementing GST.

Recently, two years after the launch of GST, The government began one of the biggest reviews of GST. In the review the government detected an evasion close to RS. 50,000 cr.

This forced the finance commission to revise their earlier slabs of GST.

GST collections during the first half of 2021 grew under the shade of 5% as compared to an expected rate of 13%. Weak enforcement in the states has also been one of the major factors of reduced collections.

Finance Commission Chairman NK Singh reviewed the slabs at 5%, 12% ,18% and 28%. These rates have been implemented from 1st Oct 2021.

1st JULY 2021, marks the completion of four years of the biggest tax reform in the Independent Indian History, GST which includes all indirect taxes under it. Though it has been 4 years but still it continues to face several challenges.

Challenges in GST

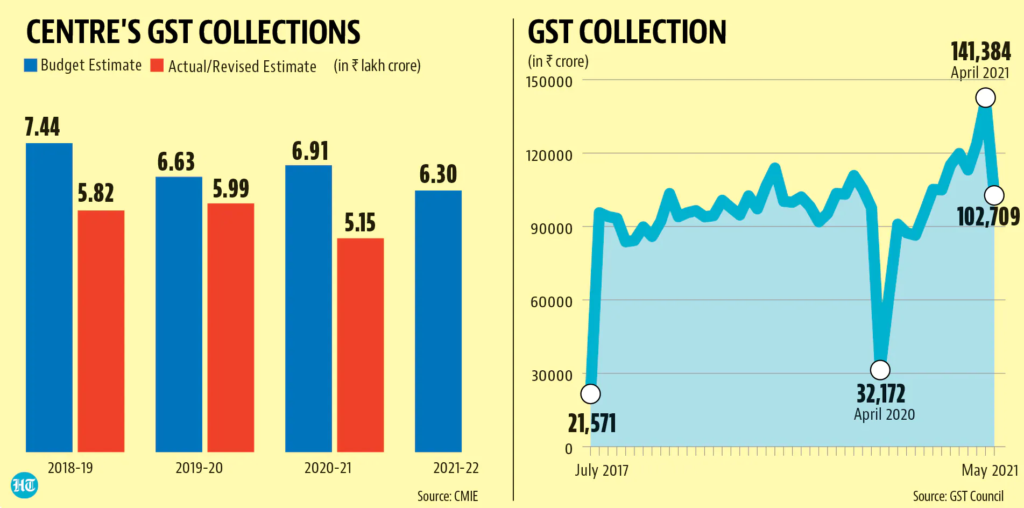

In the first year after implementation of GST, fiscal year 2018-19 , the total revenue receipts collected by the government amounted to Rs.7.43 lakh crore as compared to the actual amount which was only 78% of the receipts. The situation improved in 2019-20 where the actual collections were 90% of the receipts by the government. Before pandemic in 2020 and post pandemic in 2020-21 the GST collections were lower than Rs. 6.63 lakh crore as compared to the nominal collection by receipts which was much higher than Rs. 6.63 lakh crore.

There were surprisingly higher collections in January, March and April 2021 as compared to previous years.

According to a report by the GST Council it was estimated that there is a requirement of Rs. 3 lakh crore but the actual amount received by collection was only Rs.65000 crore. Rs.97000 crore is the amount of total shortfall on account of only GST out of the total Shortfall of Rs. 2.35 lakh crore. Excluding this Gst shortfall, other reductions were due to the impact of Covid-19.

Due to this shortfall, the Central Govt had to propose borrowing from the State government to which most of the state governments signed off. The states complaining about the delaying payments by the Central Government is also very common. This has led to a serious loophole in the Indian Fiscal policy framework.

The guaranteed revenue growth given to the state government has created a serious hazard for the GST Council.

There are recommendations for reducing GST slabs on all kinds of commodities very frequently. This is also one of the primary reasons for lower revenue collection and a lower weighted average GST. The weighted average GST rate was only 11.6 % in Sept 2019 as compared to the proposed average GST of 15.3% proposed by the ARVIND Subramanian Committee.

GST has become more of a tax game in the towns rather than providing a sense of relief to the masses. During the pandemic it was also demanded that Gst should be waived off on pandemic related commodities. This has created situations even worse rather than improving it.

According to a survey, there is a regressive shift in the Indian’s tax burden. As it is known that indirect taxes put a more burden on the poor as it does not differentiate between the rich and the poor. Moreover, the Covid – 19 pandemic has In Fact widened the gap between the rich and the poor instead of narrowing it. This has also led to a fall in employment opportunities for the poor segment of the society.

These concerns may lead to the exploitation of indirect tax routes.

When we see the other side of the coin of GST, it is evident that the government has brought the country closer by removing inter state barriers thereby enabling ease of doing business all over India.

Today, India has become a true economic market by lowering down the economic distortion amongst the states. There were 1.23 crore registrations in July 2020 as compared to only 38 lakh taxpayers in July 2017.

The IT sector has also played a major role in implementation, functioning and collection of Gst throughout the country. Harnessing technology through GSTN which detects errors in frauds includes data mining and analytical tools. These technological transformations have increased the compliance, assurance and vigilance of the taxpayers thus avoiding complications at the time of payment and increased transparency throughout. The increased transparency has been an advantage to the government by busting a racket of tax frauds and illegal billings by lakhs of businessmen. A speedy dispersal of GST settlements has set an excellent example thus resulting in an upliftment of the exporters.

Increased rules for GST registrations in online mode has poured challenges for small scale businesses who don’t even know how to operate basic systems on mobile and laptops.

In some cases the online transactions of GST, has also resulted in non-payment or delays in transactions which has eventually led to unwarranted litigations. Earlier businesses with annual turnover of above 1.5 crore were liable to pay tax but now the SMES and other businesses with annual turnover of 20 lakhs or above are liable to pay tax thus increasing tax compliance, compulsion and burden. Unreliable and non uniform IT platforms have sometimes forced the governments to extend the due dates.

In the upcoming months it is further expected that India may consider Higher GST and fewer rates. The 5% and 12% rates may be further raised to 6% and 13% respectively.

The taxpayers are also in a hope that the governments will modify the tax regime thus ease in the tax payments.

Basic Problems and Suggestions for GST

As per 22nd July 2021, there have been 39 registered issues with the proper functioning of the GST. The report of the same has been submitted to the Finance Ministry of India.

- Confusion of Trade Name on GSTN

It is always the trade name which is mentioned on the invoices and other important documents for day to day functioning of the business. But the GSTN registration is only granted on the basis of the owner’s PAN due to which in many of the documents the proprietor’s name is mentioned instead of the trade name. This creates a whole lot of confusion while doing B2B as well as B2C business.

Suggestion : Trade name of the firm should be used instead of Owner’s PAN for registration.

2. Compliance Ratings :

According to CGST Law every person has to be assigned a compliance rating by the government who have registered but the same has not been implemented.

Suggestion : To make the flow of businesses easier and business cycles smoother for MSMEs, it is necessary to implement Compliance Ratings. This will help in easier procurement of goods and services.

3. GST on Petroleum Products

All the petroleum related products such as petrol and diesel have been excluded from GST . It has been suggested by businessmen and other groups of individuals from all over the country that GST should be implemented on these products as well to curb inflation and to rationalize the processing of these products as well along with the availability.

4. Lower the Time Limit for Refund

Section 54 (1) of CGST provides that the application for refund will be within 2 years from the date mentioned as per section (2) of CGST Act. However, in most of the cases, the knowledge of refund to the taxpayer comes when the two years time has lapsed or when the Annual Return of GSTR-9 is prepared.

Suggestion : The time period should be of One year after the due date of Annual Return or two years from the relevant date and the refund should be made permissible in GSTR-9 return also.

5. Option to pay interest under CGST/SGST Act.

The interest which the taxpayer is liable to pay is calculated under on act i.e CGST/SGST which results in an auto-calculation of the interest in the other head also. Also, the liability of CGST/SGST is also not the same every time. The taxpayers face a host of problems while filing the returns at the time of paying interest.

Suggestion : The taxpayers who are liable to pay interest should be given the option of paying different amounts of interest under CGST/SGST ACT 2017.

6. Filing of Appeal under State of Registration

If the conveyance or transporter carrying goods has been intercepted and the penalty is passed, then the taxpayer has to file an appeal against the order only in the Intercepted State which makes the process a way more cumbersome and difficult for the taxpayer. Also all the Business documents are seized by the State of Interception officials which hampers the ease of doing business. This results in wastage of huge time, effort and money. Also the people involved sometimes indulge in corrupt practises outside the state.

Suggestion : The appeal of the interception and liability should be applied in the State of Registration of business and the documents seized by the Intercepted State should be sent to the registered state via mail by digitally signing the documents. This will reduce the wastage of money, time and efforts and also provide an ease of doing business.

7. Tax on Advance received against supply of Services

There is a condition of paying tax in advance received against supply of goods and services which makes the transactions more complicated and increases compliance burden for paying tax.

Suggestion : Tax on advance received should be removed to make things simpler.

8. Export of Intermediary

Under this rule the payment of intermediary services is received in foreign currency and services are received by foreign suppliers.

Suggestion : Inorder to boost the Services sector the gst rates on these services should be lower than 5%.

9. GST comes as Additional Operational Cost for Small Businesses

Small medium Enterprises and Micro Term Enterprises (MSMEs) are not financially stable to purchase computers and appoint Chartered Accountants for filing the returns and making annual reports. Due to absence of this, these enterprises are unable to assign MRP on their handmade and local products. Due to the illiteracy of small artisans and dealers they are unable to figure out appropriate MRP for their goods. Due to these trust issues, these small businesses are unable to pay GST returns and don’t pay tax. Some dealers who are exempted from paying taxes do not have an exemption certificate which results in trust issues by customers who demand bills for purchase.

Suggestion : Exemption certificates should be provided to businesses in order to maintain B2C relations, transactions and ensure validity of business.

Direct Taxes

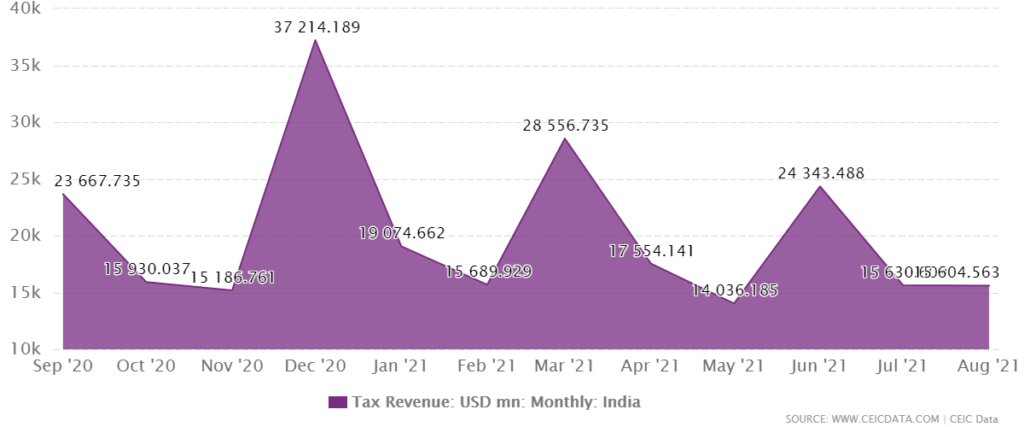

The gross direct tax collections for the financial year 2021-22 has increased by 47% whereas the Net direct tax collection for the fiscal year 2021-22 rose by 74%. There is an approximate growth of 56% in the Advance Tax Collections for the financial year 2021-22 where the collections stand at Rs. 2,53,353 crores as on 22nd September 2021. The total value of refunds which have been issued stands at Rs. 75.11 crores.

The gross tax collection includes Corporation Tax (Rs. 3,58,806 crores), Personal Income Tax including Security Transaction Tax (STT) which amounts Rs. 2,86,873 crores, other minor direct tax collections comprising Tax Deducted at Source (Rs. 3,19,239 crores), Self Assessment Tax (Rs.41,739 crores) , Regular Assessment Tax (Rs.25,558 crores), Dividend Distribution Tax (Rs.4,406 crores) and other minor taxes which amounted to Rs.1383 crores. The gross collections (after adjustments of refund) registered a growth of 16.75%.

Some of the direct taxes in India according to Alagapann (2019) are

- Income tax

- Corporation Tax

- Dividend Tax

- Capital Gains Tax

- Wealth Tax

- Gift Tax

- Estate duty or Inheritance tax

- Land Revenue

- Agricultural Income tax

- Professional tax

Income Tax

Income tax is the tax that an individual, including Hindu Undivided Families, companies, firms, associations of persons or bodies of individuals, local authorities and other artificial judicial persons pay to the government as some portion of their income. It is chargeable under the provisions of Income Tax Act, 1961. In India, the income of an individual is over Rs. 2.5 Lakh per annum is taxable. Till 2020, India had a single tax regime. In the 2020 budget, the government introduced a provision of two tax regimes. An individual gets the choice to adhere to any one of the regimes, whichever they find more convenient. Both tax regimes follow a progressive tax slab system, i.e., tax liability increases as income rises. It is reasoned that following a progressive system facilitates a more equitable wealth reallocation.

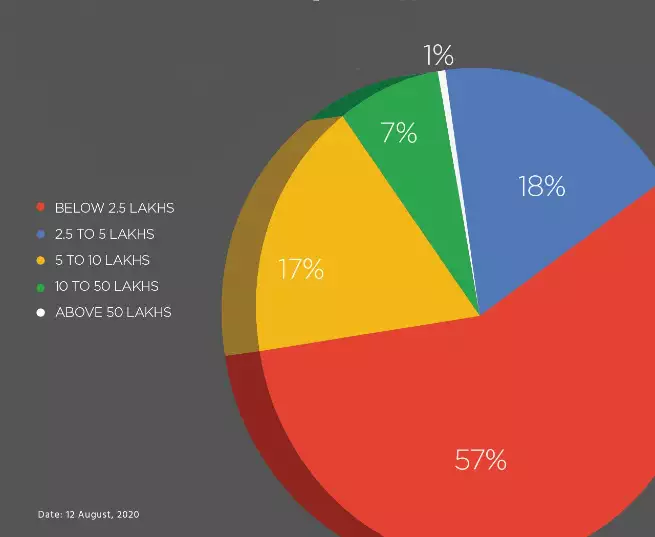

The government struggles in stimulating income tax compliance. Of a country of about 140 crore people, only 1.46 crore pay tax, amounting to roughly 1% of the population. As per 2020, 1 crore people have disclosed their incomes between 5 and 10 lakhs. Only 46 lakh people disclosed an income of over 10 lakhs.

Source: TOI Website

Income Distribution of Individuals who filed ITR

(Note that this is not the income distribution of the total population)

New Income tax return portal was launched by the Government of India on 7th June 2021, though it was launched for providing an ease in transactions but it has posed many challenges in front of the government as well as the taxpayers. The portal is unable to identify and verify documents, non launching of schemes of ITR and non registration of PAN\TAN.

In the 2021 Budget the Tax-GDP ratio was further reduced to 3.7% from 6% in the previous years.

The Government and the Finance Ministry is also planning to make improvements in the online mechanism of paying tax in assistance with the tax officials of the country.

Businesses in India are assured of tax regime stability and predictability.

Giving a stable tax regime and lower tax for Corporates, Investors and Businesses is the main aim of the Government’s Tax Regime Policy.

The correct approach is to widen the tax base rather than increasing the tax rates.

Corporate Tax

Acts like the Companies Act 2013, renounce corporations of the legal identity of an actual person. Thus, corporations are like an ‘artificial person’ in the eyes of the law. As such, corporate tax or corporate income tax is the tax charged over these artificial persons. In simple words, it is the tax charged on the income of registered companies and corporations in India.

The corporate tax rate (hereon CIT) is 22 percent for domestic companies. CTR was slashed to 22% from 30% in 2019 in an attempt to revive the economic landscape. With all cess and surcharges in consideration, CTR amounts to 25.17% in effect. For new companies incorporated after 1 October 2019 and beginning production before 31 March 2023, the tax rate is 15 percent. Both rates apply only if a company claims no exemptions or concessions.

For foreign companies, the tax rate is 40 percent (50 percent on royalties and technical services). Surcharges and cesses, including a four-percent health-and-education cess, are levied on the flat rate.

As per the statical figures by Controller of General Accounts (CGA), the corporate tax collections during the first five corresponding months of FY 2021-22 stands at Rs.1.68 lakh crores as against Rs.64,715 crore during the last year accelerating a growth of approximate 159.68%.

The United Nation India Strategic and Partnership Forum applauded the Indian government’s role in the Global Minimum Corporate Tax Rate of at least 15%. India’s supportive stand on a fair international tax system will align India towards a digitalised and globalised world economy. This initiates the beginning of the biggest corporate tax reform by US OSPF over the century. India is expected to follow this path which will provide tax certainty, prevent double taxation, reduce compliance and litigation for multinational companies.

Capital Gains Tax:

Capital gains tax is a tax levied on realization of taxable assets such as stocks, real estate investments, mutual funds, etc. These are the taxes levied by state authorities on capital and property owned by individuals. They collect land tax for land revenue and road tax for motor vehicles. This tax is payable when you get a significant lump sum of money. They include two types of capital gains, long-term capital gains and short-term capital gains. The long term capital gain tax can be further classified into two categories i.e. long term capital gain tax on equity and long term capital gain tax on other assets. Similarly, this follows for short term capital gains tax on equity and other assets. The tax applicable for both is different as short-term gains tax is computed depending on the income bracket. The short term capital gain is taxable at 15% provided STT is already paid. The capital gains tax rate and structure for non residents depends upon the type of asset holding and period for which the asset is held. These tax rates exclude health and education cess which is charged at a rate of at least 4%. However, the non-resident Indians (NRIs) are not entitled to avail the benefits.

The relief from double taxation is provided to the NRI only if India has signed a Direct Taxation Avoidance Agreement (DTAA) with the country in which the resident resides.

The sale of equity oriented mutual funds is taxable at a rate of 10% and above only if the profit on sale is more than 1 Lakh. The cost of acquisition of assets does not include any indexation benefit.

Capital gains tax is considered by many critics to discourage productivity and innovation. E.G., if an individual wants to trade an underperformer stock for a potentially performing stock, his incentive is lowered to the extent of the tax rate.

WEALTH TAX

The wealth tax in India was first introduced in 1957, through the Wealth Tax Acts which was charged on the assets owned by the person. The tax was taxed upon those who had a minimum net worth of Rs.30 lakhs or more than that. The tax was abolished in 2015 budget (effective the following fiscal year). This was because it was recorded that the cost incurred in collection of the tax was more than the net benefit.

It was replaced with an additional surcharge of 2% on individuals with income over 1 crore.

Problems with the Indian Tax System

Like any system, the Indian tax system has many issues which leads to incompetence and inefficient collection. The system is quite complex given that the government tries to tend to the needs of a population diverse and as huge as approx 140 crores.

1. LOW ABSOLUTE COLLECTION

India’s collections of taxes was approximately Rs. 12 lakh crores in the financial year 2017-18. That’s roughly 10,000 rupees per capita tax collection. Revenue collection from indirect taxes is double the collection of revenue from direct taxes as per Ghude and Katdare, 2015. Despite the higher rates of direct taxes as compared to indirect taxes, the collection or revenue from direct taxes is not satisfactory. Only a shallow collection of GDP is collected in Taxes. The higher tax rates in developing economies like India lead to more tax evasion which ultimately results in black economy at the end of the day. The incidences similar to indirect taxes are much higher in India as compared to any other developing country.

2. EXEMPTION OF AGRICULTURE SECTOR

While it is true that the agriculture sector needs some remittances, total exemption is not economically viable. The biggest loophole exploited by the liable is to forge their profession as a farmer even if they are engaged in other sectors. Despite the statement stated in the State List in the Constitution’s VII schedule that states are liable to tax agricultural income, agricultural Income tax is exempted from the Indian Tax System. Despite the astonishing fact that agriculture provides employment to more than half of the population, The agriculture sector is still excluded due to the vote bank of the government. Secondly , the tax collected from the agriculture sector will not cause much of a difference because the profits are negligible.

3. HIGH RATE OF INVASION

A major chunk of the public tends to evade taxes. This leads to generation of high amounts of black money. History has decreed such a tendency, unfortunately to its political leader.This creates an existence of Black economy due to tax evasion and the non utilization of black money back into the economy also produces loss of helpful productive activity in the country. According to a recent report by the IMF, unaccounted money (Black Money) in India accounts for at least 50% of the GDP. The rate of black money in the economy is increasing in both absolute and relative terms by the percentage of GDP. The growth rate of black economy is much higher than the actual growth rate of the economy. This shows that half of the GDP of India is tax free which results due to the underground or the Black economy. This poses a serious threat to the growth and stability of the economy in India.

4. HIGH DEPENDENCY ON INDIRECT TAXES

Economic theory suggests that taxes should be progressive in nature. In contrast, Indirect taxes are the exact opposite, regressive in nature. Because indirect taxes are levied equally across all the population, income erosion is higher for the lower class. The major chunk of the tax collection in India especially is from GST, Union excise tax, service tax and customs duty tax. The principal contributor in the collection of direct taxes is mainly the corporate tax and the income tax. Rest all other taxes including land revenue, agricultural income, wealth tax, gift tax etc. contribute merely 2.59% of the total tax collection.

5. LOW POPULATION WITH LEGAL TAX LIABILITY

Only 4.5% of the total population is legally liable to pay taxes. Even out of such a small proportion, only a significantly small population pays them.

6. COMPLEX AND TIME CONSUMING FILING

The compliance system in the Indian tax regime is quite complex and users have often reported facing difficulties in filing tax returns. There has been an excessive increase in the expenditure on collection of tax by the government from time to time but by levying of GST this cause has been resolved but still it continues to persist.

7. REAL ESTATE SECTOR

Real estate owners transfer illicit money. It is a well known and a common fact that all real estate transactions are done on a lower paper price than the market value which allows the buyer to use his/her untaxed funds and thus evading income tax of the seller. Strict laws, checking and restrictions should be made regarding the same. The evasion of stamp duty is proportional to the evasion of transferred property.

8. LACK OF EDUCATION

It is rather ironic that while paying taxes is considered to be the most crucial duty of any citizen, it is not taught in the school education curriculum. Thus, individuals tend to get confused given their misinformation and absence of organized information or sources.

Suggested Steps to improve the system

Bringing Rich Farmers Under Tax Liability: As discussed above, absolute liberty to the primary sector has done more harm than good. It is high time that this policy is revised and agriculture is brought under the tax regime. Increasing revenue from agricultural tax and land revenue should be made priority as compared to other direct taxes. Tax rates should be reduced.

Strict Enforcement Of Anti-Tax Evasion Laws: The section 276c of the Income Tax Law has prosecution provisions for non-fulfillment of tax duties. Willful refraining from tax payments can lead to penalties depending upon the size and nature of the dues. The law also provides provisions for imprisonment of the defaulter. However, the government and enforcement agencies often play pretense while in practice implementation of laws that curb tax evasion. Statistics show that no individual has landed in prison for non-payment of taxes. This is in vast contrast to various developed and rich countries, where headlines of millionaire defaulters being prosecuted often make the rounds.

The government needs to focus on improving discovery capabilities of the defaulters. A report by the State of Tax Justice, issued in November 2020, revealed that India is losing ₹75,000 crores of revenue annually from tax evasion.

The main goal of better tax administration should be to bring more and more taxpayers under the income tax bracket through a constant tax evasion check. Tax collection from indirect taxes such as entertainment tax, registration fees and tax on vehicles should improve. There is a need to reduce government expenditure on collection of taxes by decreasing the multiplicity of taxes. Discretion should be used in a transparent and equitable manner.

Pigouvian Taxes: Pigouvian taxes are the taxes that are charged as a remedy towards negative externalities on market transactions. Examples include tobacco tax, sugar tax and carbon tax. While pigouvian taxes are already in effect, the government should look for possibilities to widen its horizon. Such taxes are a great means for tax correction in lieu of activities harmful to the society. As of now, the government has put tobacco, alcohols in the 28% (highest) GST bracket, essentially charging a pigouvian tax. An approach can be to use big data to correctly estimate the costs of the externalities and implement tax rates accordingly. Big data can help to deal with the complexity of one externality having multiple dimensions. For example, fossil fuel extraction has negative costs on the climate and it also leads to degradation of health.

Introduction Of Taxes And Personal Finance In School Curriculum:

If individuals are taught about the importance of tax compliance and the procedures involved, instances of tax evasion can be curbed. Studies have suggested that the early age is the best for fostering basic education, as it is the biological stage of the development of the human brain. It is high-time the government realizes that managing finance is a necessary life-skill and adds it to the school curriculum. Introduction, education and implementation of cashless transactions should also be a part of school syllabus. The working and use of digital transactions should be encouraged from the school level itself till the market of the consumers. This will also lead to the emergence of a paperless economy and reduced tax evasion. This will also provide a sense of knowledge, security and independence among the school children. Through the DIGITAL India Campaign, we are able to achieve some of the objectives but still we have a long way to go.

Managing loans, taxes, credit, banking, importance of passive income, investing are some areas which the administration can ponder about. This would also encourage practical learning, a step which the education ministry seemed keen to adopt in the New Education Policy.

In recent times, an influencer trend towards personal financing has been noted. Prominent names in the internet world have taken the initiative to educate their audience about personal finance. While this is undoubtedly a grand step forward, hindrances like unorganized information, and the tendency to skip courses in between, make it certain that the issue in a complete way can only be solved through formal education.

THE PROGRESSIVE VS FLAT DEBATE

In India, a progressive tax system is followed, i.e., tax rates increase with rising incomes. The government says such a system ensures to curb the increasing rift between the haves and have-nots of the society, and help the government to reduce income disparity, and reallocation of resources more efficiently. This system is criticized for the nuances of a complex system. It also discourages high income (curbing innovation).

A progressive tax system gives the scope of tax planning2.. While tax planning in itself is a great step, its poor implementation often causes it to do the reverse effect of the intended. Critics argue that tax management is just a way for the rich to legally evade taxes. The poor are not able to take advantage of this system given their lack of knowledge. In effect, the poor end up actually being taxed more. Such a situation is a classic example of what is referred to as the ‘vicious circle of poverty’3 by economists.

The flat tax system, i.e., a universal rate of tax for the rich and poor class alike is advocated for its simplicity and a model that rewards innovation. It is also argued that the monetary benefits the rich get from tax cuts are ultimately reaped off by the poor alike as the rich have more to dispose of. This is regarded as the ‘trickle-down’ effect by its advocates.

HOW GOVERNMENT SPENDS ITS TAX REVENUE?

Theoretically, the government is expected to use its tax revenue to maximize welfare.

The government of tax is liable under the RTI Act to provide public information of its spending. The below data was compiled from the government’s budget documents.

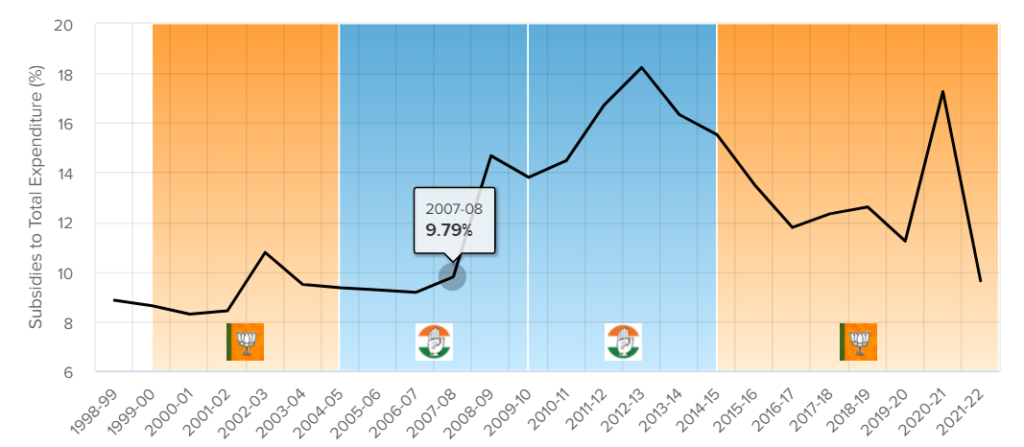

Subsidies: Being a poor country, the government has to spend a major chunk of its revenue to complement the very poor of the basic necessities. Few examples are LPG, rail fares, manure and fertilizers.

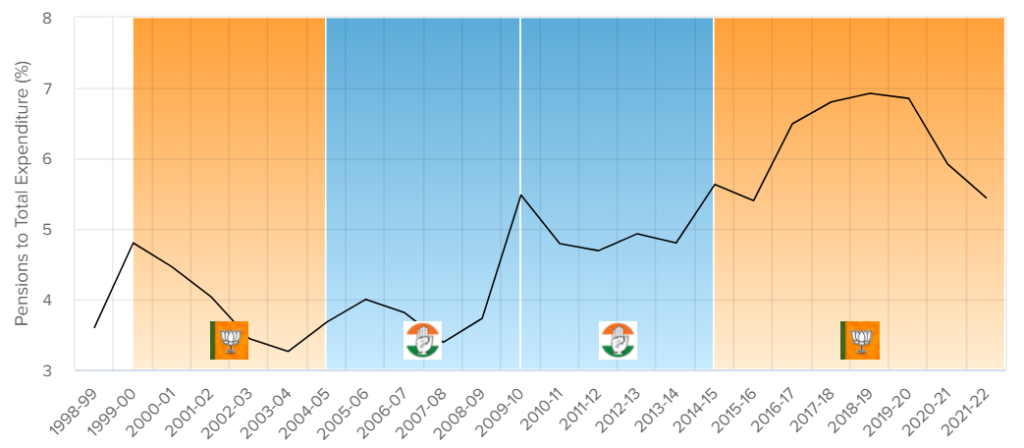

Pensions: To incentivize government sector jobs and compensate the governments over the world have adopted the model of pensions. Pensions can be of various kinds for different reasons. Examples of pension beneficiaries are senior citizen pensions, veteran and retired soldiers, widowed wives, and other retired government officials.

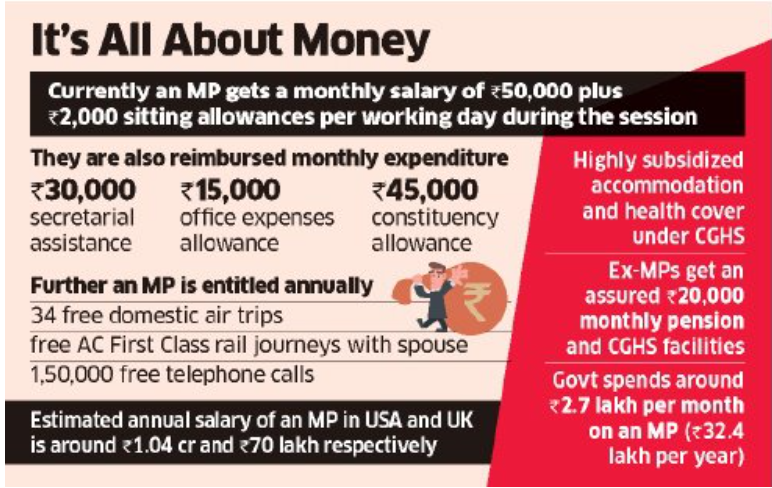

The laws provide for pensions to MLAs and MPs as well. Various reports suggest that the major proportion of these beneficiaries are not needful. After every few years, these pension rates are revised. The bigger problem here is the conflict of interests. MPs and MLAs often push for a higher pension rate using their voting powers.

Image Credits: Economic Times

Interest Payments

The government has to spend on the interest payments of its borrowings.

Image Credits: Times of India

INCREASING TAX COMPLIANCE

Increasing tax rates above a certain threshold starts to discourage investment. As such, rich people always have resources to escape tax enforcement. Many individuals have the perception that taxation is just a means for the government to take away their hard-earned money. Non-efficiency and bureaucracy in the administration further strengthens this belief.

Changing this narrative is crucial towards building a tax compliant economy. The government should establish open communication with the taxpayers. It should clearly release periodic statements of how tax revenue is spent and demonstrate and appreciate the taxpayers’ contributions.

Nudge theory in economics suggests that greater efficiency can be achieved through accurate deduction of the behaviour of taxpayers and deploying strategies in accordance.

GLOSSARY

INCOME: Income of an individual/institution in the course of one fiscal year (April to March of succeeding year). (Unless specified otherwise)

TAX PLANNING: Tax planning is the process of taking tax benefits from the legitimate means prescribed in the law.

VICIOUS CIRCLE OF POVERTY: A cycle of self-sustaining poverty that continues until outside intervention.

📌Analysis of Bills and Acts

📌 Summary of Reports from Government Agencies

📌 Analysis of Election Manifestos