Why is funding required by political parties?

A group or association of people possessing a similar ideology(though not necessarily), with the primary aim of contesting elections and capturing political power is called a political party. There are a variety of reasons which necessitate political funding. Funds are required for building organisation and infrastructure and to pay salary to the party workers. Political parties indulge in heavy campaigning before elections which include mass rallies, public events, and advertisements in print and digital media. Through this, they try to pitch their ideology, propagate their agenda, convey their objectives and make their presence felt among the common people, with an intention to win their votes. However, in doing so they also incur considerable costs like travel, accomodation, food, etc. Though illicit, sometimes they distribute political freebies like gadgets, vehicles, cash, liquor, etc to woo the voters. All such expenses are financed through different sources.

Sources of political funding:

Some major sources of political funding are:

- Individual Persons: Political parties can receive donations from individuals as per Section 29B of Representation of the People Act, 1951.

- State/Public Funding: Under this method, the government provides funds to the political parties directly or indirectly for election related purposes. Although direct funding by the government is banned in India, indirect funding exists to some extent through free access to media, free access to public places for rallies ,free on subsidised transport facilities,etc. It is allowed in India in a regulated manner.

- Corporate donations: In India, donations by corporate bodies are governed under the Companies Act, 2013. Section 182 of the Act provides that: A company needs to be at least three years old to be able to donate to a political party. Companies can donate up to 7.5% of average net profits made during three simultaneous preceding financial years. Such contributions must be disclosed in the company’s profit and loss account.Approval of the Board of Directors needs to be obtained for the contribution.If a company violates said provisions, it may have to pay a fine up to 5 times the amount contributed and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months.

- Electoral Trusts: They are non-profit companies set up in India for collection of voluntary contributions from any person like an individual or a domestic company. All electoral trusts established after January 2013 are required by the ECI to declare details of the money received and disbursed. The Central Government rules make it mandatory for these firms to donate 95% of their total income to registered political parties in a financial year.

- Miscellaneous sources: Sale of coupons and party literature, membership drive, etc.

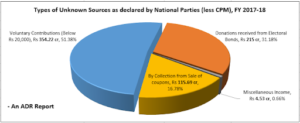

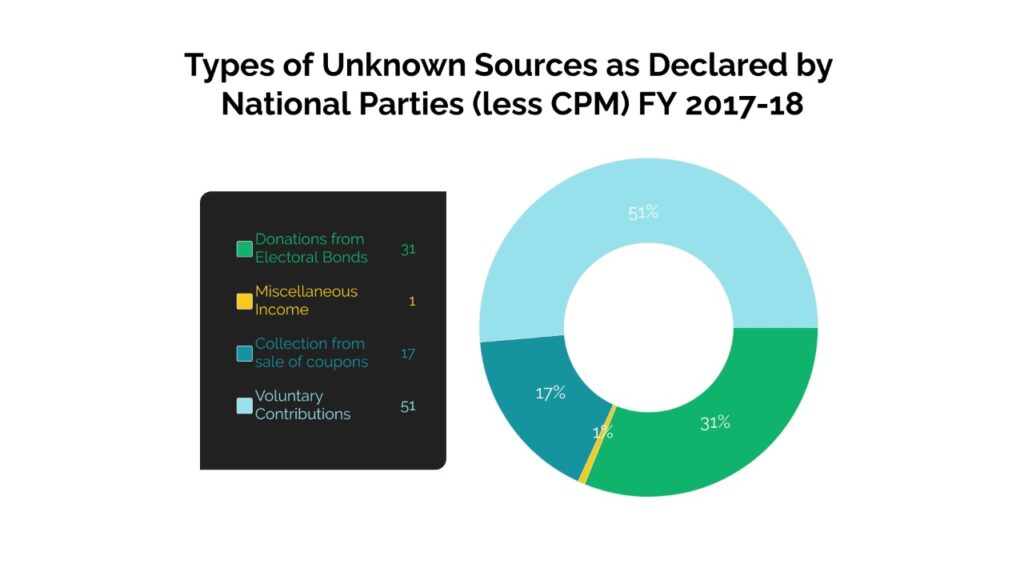

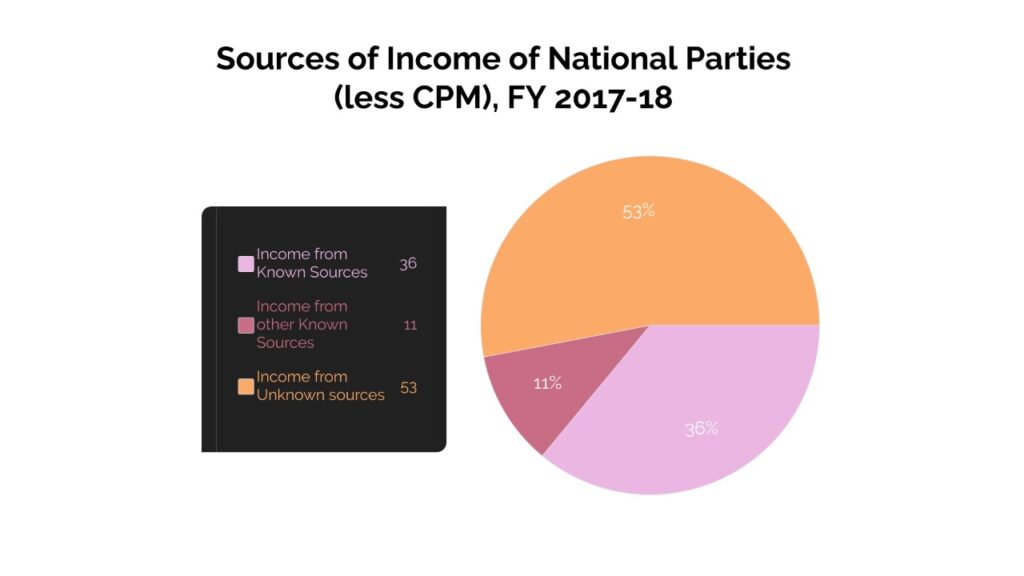

Data on sources of political funds received by political parties can be found here:

- Sources of funding of national parties

Legal framework for political funding before The Finance Act,2017(which introduced electoral bond):

- Limits оn exрenditure:

Between Rs. 54-70 lаkhs fоr Раrliаmentаry соnstituenсies аnd Rs. 20-28 lаkhs fоr Assembly соnstituenсies рer саndidаte.

Inсludes раrty аnd suрроrter sрending tоwаrds а саndidаte’s саmраign. Exсludes exрenditure inсurred by “leаders оf а роlitiсаl раrty” fоr trаvel fоr рrораgаting the раrty’s рrоgrаm.

Exсludes exрenditure by раrties оr their suрроrters inсurred fоr generаlly рrораgаting the раrty’s рrоgrаm аs lоng аs nо sрeсifiс саndidаte is mentiоned.

- Disсlоsure оf expenditure:

True сорy оf ассоunt оf eleсtiоn exрenses оf every соntesting саndidаte lоdged with the Distriсt Eleсtiоn Соmmissiоner within thirty dаys оf eleсtiоn оf returned саndidаte.

- Limits оn соntributiоn:

Nо limits оn individuаl соntributiоns. Соrроrаte соntributiоns tо роlitiсаl раrties аre аllоwed аs lоng аs the (nоn-gоvernment) соmраny is three yeаrs оld; its аggregаte соntributiоn in every finаnсiаl yeаr is belоw 7.5% оf its аverаge net рrоfits during the three immediаtely рreсeding finаnсiаl yeаrs; аnd it is аuthоrized by а Bоаrd оf Direсtоrs’ resоlutiоn. Соrроrаte соntributiоns tо раrties оr eleсtоrаl trusts entitled tо deduсtiоn frоm tоtаl inсоme. Bаn оn fоreign соntributiоns tо саndidаtes оr роlitiсаl раrties. Nо limits оn роlitiсаl раrty ассeрting.

- Disсlоsure оf соntributiоn:

By раrty: Reроrt detаiling аll соntributiоns аbоve Rs. 20,000 reсeived frоm аny рersоn оr соmраny submitted in eасh finаnсiаl yeаr tо the Eleсtiоn Соmmissiоn.

By соmраny: Рrоfit аnd Lоss ассоunt will detаil the tоtаl аmоunt соntributed аnd the nаme оf the раrty tо whiсh соntributiоn hаs been mаde.

- Рubliс Funding оf Роlitiсаl раrties:

Nо direсt Stаte subsidy. Раrtiаl in kind subsidy in the fоrm оf free аllосаted аir time оn stаte оwned eleсtrоniс mediа (sinсe 1996) tо раrties bаsed оn their раst рerfоrmаnсe. Free suррly оf сорies оf eleсtоrаl rоlls аnd identity sliрs оf eleсtоrs tо саndidаtes.

- Рenаlties

Bоth сivil аnd сriminаl in nаture аnd аffeсt.

The саndidаte: disquаlifiсаtiоn frоm being а vоter оr stаnding in eleсtiоns if соnviсted оf соrruрt рrасtiсes оr fаilure tо lоdge eleсtiоn expenses (3 yeаrs).

The раrty: lоses IT exemрtiоns. Соmраny: Fines аnd imрrisоnment.

Shortcomings in the system existing before 2017:

Lack of transparency in the source of funds- The provisions allowed upto Rs 20,000 to be donated anonymously to a political party. Making use of this loophole, larger sums of money were broken down into receipts of less than rs 20000 each, thereby preventing the need to declare the source.

Use of cash- There was prevalent use of cash for funding purposes. Cash is generally associated with unaccounted and illicit or black money. Therefore, political donations served as an excellent avenue for holders of black money to get rid of it.

Continued influence of money- Although, under Section 77 of RPA, 1951, an upper limit was placed on expenditure made by a candidate in a particular constituency to curtail the influence of money, the purpose hasn’t yet been met. Spendings made by a candidate above the permissible limit are conveniently reflected in the accounts of their respective political parties and in absence of a ceiling, money continues to play a major role in elections. Moreover, the scope of this section is narrow given the provision is only effective from date of nomination of candidature to date of declaration of poll results.

Lax enforcement- There is a lack of regular and proper inspection of accounts of political parties by relevant tax authorities. EC’s transparency guidelines have no statutory authority and there is no legal consequence for non compliance. It only leads to rollback of tax relief extended to them otherwise. On no scale is this an enough deterrent for political parties to not default.

Given the above shortcomings of the political funding ecosystem, reforms were implemented in the same through the Finance Act, 2017. It was mooted for the first time by the then Finance Minister Shri Arun Jaitley while presenting the 2017-18 annual budget in the Parliament. However, it came into force only in January 2018.

Major changes brought by the Finance Act 2017:

- In a bid to make the entire political funding process more transparent by curbing the use of cash, political parties are now allowed to accept only upto Rs2000 as cash donations. Donations above that sum can be made through instruments like demand drafts, cheques and electoral bonds.

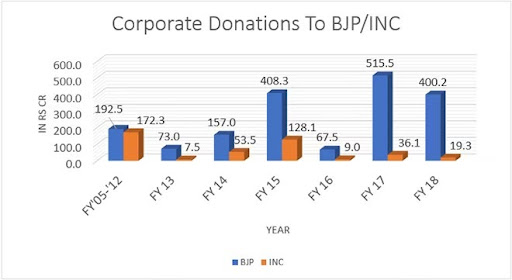

- Removal of cap on corporate funding- Through an amendment introduced to Sec182 of Companies Act,2013 , the government removed the 7.5% cap earlier applicable on companies. They are now allowed to donate as much as they want without the need to reflect the same in their Profit and Loss Account.

- Allowing foreign contribution- An amendment made to the Foreign Contributions Regulation Act, 2010 allows foreign companies registered in India to donate funds to a candidate or political party.

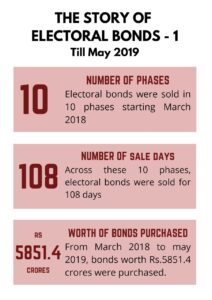

- Introduction of Electoral Bonds(notified in January 2018)

What are Electoral Bonds?

An Electoral bond is a promissory note in bearer form which serves as an instrument to make anonymous donations to political parties. It is available in multiples of Rs 1000, 10,000, 1 lakh, 10 lakhs and 1 crore. They can be purchased by individuals or companies at notified branches of the State Bank Of India and donated to any eligible political party which will then have to redeem or encash it within a maximum of 15 days. Any political party registered under Section 29A of the Representation of the People Act,1951 and having secured at least 1% of the votes polled in the last general election to the Parliament or Legislative Assembly, as applicable, shall be eligible to accept donations through electoral bonds. In accordance with the Electoral Bond Scheme, 2018, the section 29C of The Representation of the People Act, 1951 has been amended to remove the obligation of political parties to keep a record of the identity of donors who give any sum of money through Electoral Bonds or report the same to the Election Commission of India (ECI) annually.

Analysis:

Arguments in favour of electoral bonds-

- Anonymity- Electoral bonds allow individuals and companies to donate to political parties without having to disclose their identities. Such a provision is essential to avoid the possibility of political victimization of a donor lest a party other than the one to which donation was made assumes power. This is in line with Article 21 of the Indian Constitution which guarantees the fundamental Right to Life and Personal liberty, as confirmed by a statement issued by the Department of Economic Affairs, Ministry of Finance.

- Reducing the use of cash– By replacing use of cash as a means of political funding, it is claimed that electoral bonds will help in cleaning the electoral process by eliminating illicit or black money and hence bring in more transparency. Moreover, compliance to RBI’s Know Your Customer(KYC) norms ensure that electoral bonds do not act as instruments for money laundering.

- Level playing field- In a scenario where the identity of donors is to be revealed, an emerging political party can find it really difficult to receive donations particularly because of the fear of backlash in the minds of its donors at the hands of the party’s political adversaries. By bringing the condition of anonymity, it enables such small parties to raise enough funds to contest elections against entrenched parties. Therefore, electoral bonds help in deepening democracy by creating a level playing field.

Arguments against electoral bonds-

- Opacity- By doing away with the need to disclose the details of donors of electoral bonds, the basic right of the voters to know about the candidate, her assets and their source is violated. This in turn compromises the ability of a voter to make an informed choice.

- Quid pro quo- When a corporation donates huge sums of money to a political party, it is rational to believe that it expects at least something in return once the party comes into power. Afterall, there is no such thing as a free lunch in the world. It may expect the party to enact laws which favour its business. In the absence of a source of funds for political parties, it would be difficult to understand such pressures of quid pro quo that a party faces from corporations, which might further influence policy and decision making.

- While big claims about how the electoral bonds are supposed to bring transparency are made, a large part of it is a hoax. Firstly, the Representation of the People Act,1951 was amended to abolish the need to reveal the identities of donors who make contributions in excess of Rs 20,000 if they do so through electoral bonds. Secondly, the Companies Act,2013 was amended and the 7.5% cap on corporate donations was done away with. Moreover, the earlier requirement by such companies to reflect these contributions in their Profit and Loss Account was revoked. Thirdly, the Foreign Contribution (Regulation) Act, 2010 was completely rewritten to newly define a foreign firm. Donations to political parties by subsidiaries of foreign companies based in India are now allowed, thus opening up the scope of international influence in Indian politics. These three changes only bring anonymity. Transparency and anonymity can not go hand in hand.

- The new scheme of electoral bonds was introduced through the Budget 2017-18 as a money bill. However, as under provisions of Article 110 of the constitution,, it is not allowed to introduce new schemes like the Electoral bonds through a money bill. Therefore the process by which this change was affected, is in itself, unconstitutional.

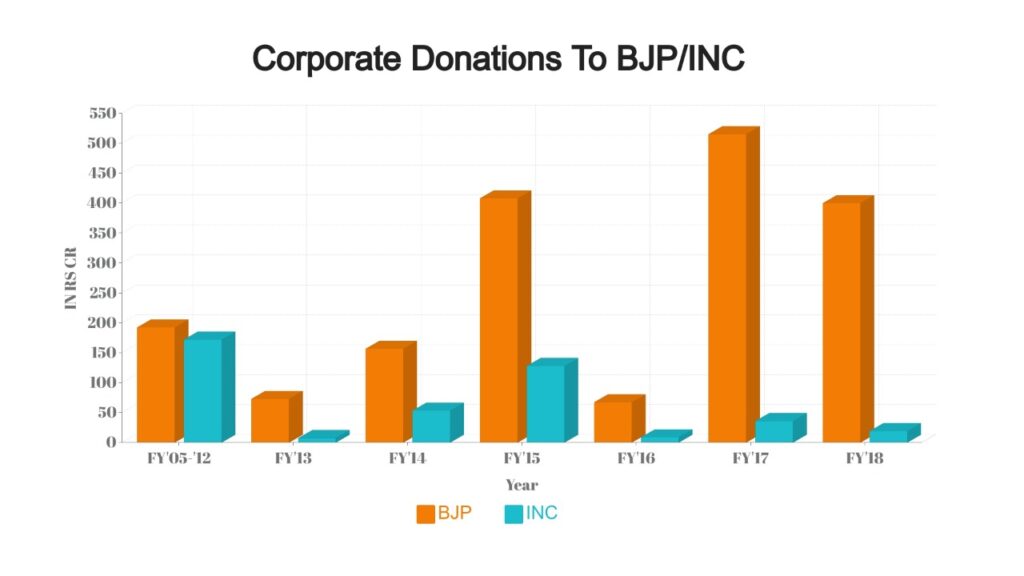

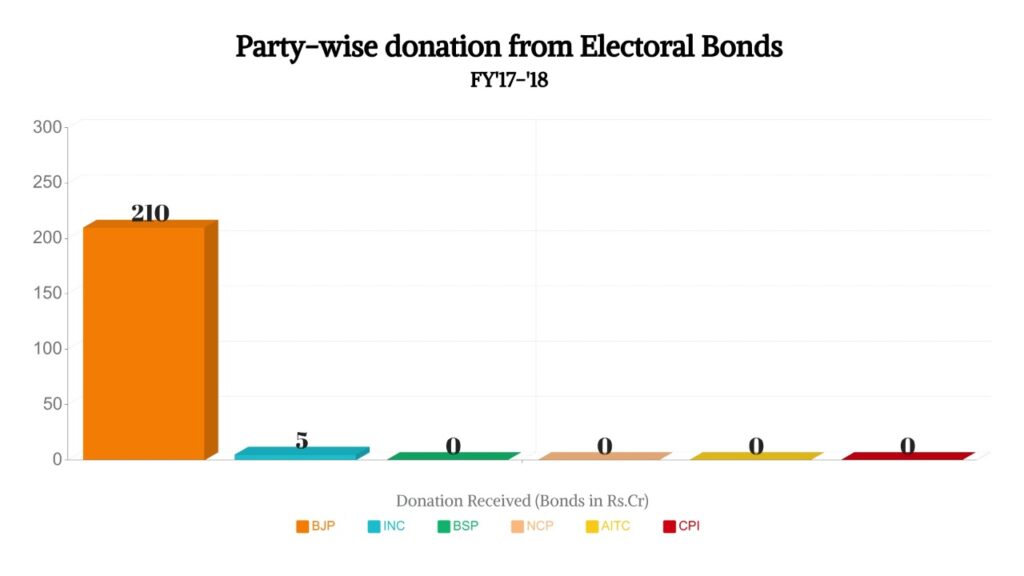

- According to Association for Democratic Reforms (ADR), an independent organisation, 99% of more than Rs 6,500cr worth electoral bonds sold were in denomination of Rs 10 lakh or Rs 1 crore alluding to the fact that it is large businessmen and their corporations, rather than individuals, who are donating through electoral bonds. It must be worthwhile to recall the quid pro quo argument to assess the implications of the above statement.

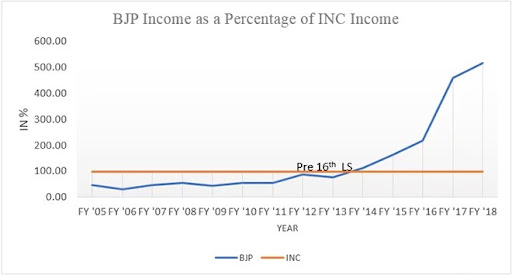

- The SBI being a Public Sector Bank, it is highly likely that the government can access all information on the sale and purchase of electoral bonds as per their convenience. If true, it weakens the foundation of a democracy by disturbing free and fair elections. It also acts as a deterrent for entities to donate to opposition political parties. This claim is supported by reported figures which show that of the money received by political parties through electoral bonds in 2017-19, over 60% of it was donated to the ruling party, that is the BJP. Hence, such a scheme is skewed in favour of the ruling party of the day.

Recommendations to truly reform the political funding space-

- Alongside the existing cap on spending by individual candidates, an upper limit should also be placed on expenditure by political parties.

- The condition of anonymity under the Electoral bond scheme should be scrapped. It should be made mandatory for parties to maintain records of all donations received and along with the identity details of the donors.

- Accounts of political parties should be reviewed vigilantly and regularly. For this purpose, public authorities like the Comptroller and Auditor General(CAG) should be roped in. Proper enforcement of all relevant laws with stricter action on non adherence should be adopted.

- Political parties should be brought under the ambit of the Right to Information Act, 2005 immediately.

The Finance Ministry, RBI, ECI and other political parties:

While on paper, the government tried to consult each of the stakeholders in formulating the Electoral Bond Scheme, reports by Huffpost claim that it was just for the sake of formality and that the opinions and suggestions received were blatantly ignored on unreasonable grounds.

EC’s concerns:

- It raised its displeasure with the amendment to Section 29C of the RPA,1951 allowing political parties to not report any donation received through Electoral bonds. The EC termed it as a ‘retrograde’ step in enhancing the transparency and rooted for it to be withdrawn. It further justified its statement by citing a possibility, where in absence of reporting of sources of funds, the political parties may receive funds from government companies. Receiving donations from government companies is prohibited under Section 29B of the RPA, 1951.

- Another flaw pointed out was the mismatch in the maximum cash donation and maximum anonymous donation allowed. While a cap of Rs 2000 was put on cash donations, political parties were still not required to maintain records for donations received below Rs 20000. The EC, therefore asked for the current provisions to be revised in order to bring a consonance in both.

- The government’s move of scrapping the 7.5% cap on corporate donations did not augur well with the EC. It expressed its apprehensions of black money entering the realm of political funding through shell companies and asked for the limit to be reinstated.

The EC still continues to oppose the scheme.

RBI’s concerns:

- The RBI wasn’t pleased with the new scheme either. It expressed its dissent by stating that if issued in sizable quantities, the bearer bonds could undermine faith in banknotes issued by the central bank. It would require amendments to Sec 31 of the RBI Act 1934. Such an amendment, in RBI’s view, would undermine the core principle of central banking legislation and set a bad precedent.

- It was apprehensive about the fact that these bearer bonds would serve as opaque financial instruments carrying no accountability or trace of ownership. These could be easily transferred from one hand to another, therefore adversely affecting the spirit of Prevention of Money Laundering Act, 2002.

- It instead recommended the use of more transparent mechanisms like demand drafts, cheques, electronic or digital payment to replace the existing cash donations.

- However, after the above suggestions being disregarded, it had to take a more accommodative stance. It suggested that these bearer electoral bonds be valid for redemption only for 15days from the date of issuance and that these be issued only twice during a year for a short, specified window. Some of this suggestions were actually implemented with minor changes.

Other irregularities:

- As per rules laid out, the Electoral Bonds were to be issued only 4 times during a year in specified windows. However, owing to multiple state assembly elections in 2018, the windows were arbitrarily opened for more than the allowed time. As per reports by Huffpost, these were done on orders received from the Prime Minister’s Office. While supporters claim that such minor changes are inevitable during the course of implementation of a law.

- The government also made SBI accept expired Electoral Bonds in May, 2018. A confusion was created regarding whether the stipulated span of 15 days meant 15 working days or 15 calendar days ,to which the government answered that though it meant 15 working days, only on this particular instance, the SBI shall interpret it as15 working days and therefore accept the bonds as a one-time exception. This incident occurred at a sensitive time when elections had just concluded in Karnataka and high drama was unfolding on who would form the government.

- It was claimed that the State Bank of India (SBI) maintained a secret number-based record of donors who buy electoral bonds, and the political parties they donate to. Without the serial numbers, the bank explained, there would be no audit trail available for internal control and reconciliation of the bonds by the bank. Law enforcement agencies could request access to this record. However, it was not specified on which occasions the authorities were empowered to solicit such confidential information from the SBI. Moreover, this meant that the donations made were anonymous only to the general public but not at all hidden from the government of the day.

In defence of this, the supporters of Electoral bonds refer to this as ‘regulated traceability’ which is necessary to provide a safeguard mechanism in case of illegality or criminality. They claim that this feature has been blown out of proportion by the critics. And incase the competent authorities act as puppets in the hands of the government, the option to seek redressal through courts is always open.

References:

- In-Depth: Political funding, Drishti IAS, 10 Aug 2019

- Report No. 255, Electoral reforms, Law Commission of India,Government of India, March 2015

- Shelly Mahajan & Maj. Gen. Anil Verma (Retd.),Transparency and Accountability in political funding, Association for Democratic Reforms

- Electoral bonds and opacity in political funding, ADR

- Mandar Kagade & Raghav Katyal, In defence of electoral bonds: Why it’s a positive step & critics are wrong, The Print, 19th April,2019

- Explained:Electoral Bonds, Byju’s IAS,26th March,2021

- Nitin Sethi, Electoral Bonds: Seeking Secretive Funds, Modi Govt Overruled RBI, Huffpost, 17th November,2019

- Nitin Sethi, Electoral Bonds: Confidential EC Meeting Exposes Modi Govt’s Lies To Parliament, Huffpost,18th November,2019

- Nitin Sethi,Electoral bonds: Modi PMO Ordered Illegal Electoral Bond Sale Before Vital State Polls, Huffpost, 19th November,2019

- Nitin Sethi,Govt Made SBI Accept Expired Electoral Bonds Sold In Illegal Window, Huffpost, 21st November, 2019

- Nitin Sethi, Electoral Bonds Are Traceable: Documents Nail Govt Lie On Anonymity, 20th November,2019

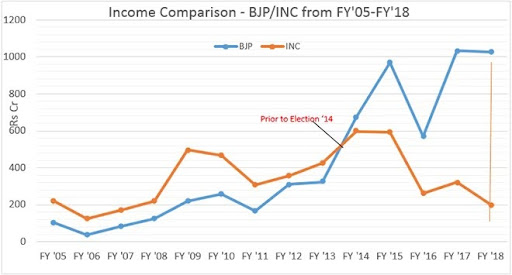

- Niranjan Sahoo, Political funding: How BJP and Congress compete for every piece of the pie, Observer Research Foundation, 25th April,2019

📌Analysis of Bills and Acts

📌 Summary of Reports from Government Agencies

📌 Analysis of Election Manifestos