Mumbai, Delhi, Tamil Nadu and Gujarat are the 4 top states that account for 70% of the total direct tax collections in the country. Even out of these four states, Mumbai alone contributes one-third of the entire collection. Imagine if the people of Mumbai demand that since Mumbai contributes more than even Maharashtra, Mumbai should be treated separately, and its money should be invested only in Mumbai? Or if the people of Bangalore say that since the city contributes more in tax than the rest of Karnataka, it should be treated separately? I even wonder what if men of Karnataka protest against women of Karnataka getting free Bus rides just because Karnataka Men pay more taxes than Women! The nation never thought of such things, but recently, the Congress Government in Karnataka cooked up a new issue of the Centre discriminating with Southern states while allocating money!

The tax devolution criteria work on the “Rich States Pay For Poor States” principle. The devolution formula is based on six factors in which 45% (the highest) weightage goes to income distance, 15% to area, 15% to population of the state, 12.5% to demographic performance, 10% to forest and ecology and 2.5% to the tax and fiscal efforts of the state. According to the 14th Finance Commission, out of Rs 100, Karnataka used to get Rs 4.713. Still, seeing Karnataka’s overall performance improved, the 14th and 15th Finance Commission revised the numbers to Rs 3.646 and Rs 3.647, respectively. The argument of BJP doing “Anyay” (injustice) should be thrown into the dustbin immediately because under the 13th Finance Commission (2010-2014), Karnataka received ₹61,691 Crores, followed by – ₹1,51,309 Crores under 14th FC (2015-2019), ₹1,29,854 Crores (already in the last four years) under the 15th FC (2020-2026) and this number will reach ₹1,74,339 Crores at the end of fifth year. Talking about the grants from the Centre received by Karnataka, under the UPA government (from 2004 till 2014), Karnataka received just ₹60,780 Crores, while under the NDA Government in the last ten years (till January 2024), the states got ₹2,08,832 Crores which accounts for about 243% increase. Apart from all this, Karnataka will also receive ₹18,005 Crores as Additional Grant-in-Aids till 31st March 2024. Karnataka has also received Rs 6,280 crores as a 50-year Interest-Free loan.

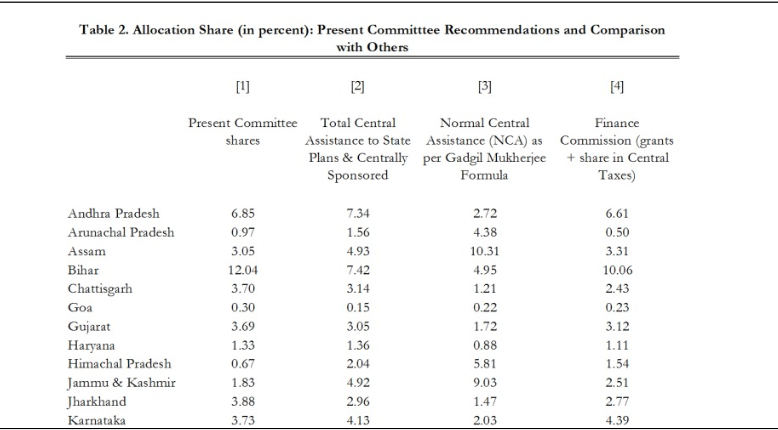

In 2013, the UPA Government set up a committee under the RBI Governor Raghuram Rajan which recommended the inclusion of backwardness index to determine the allocation of funds to the states. It was decided by the UPA Government that 60% of the Central funds will automatically be transferred to the poorest states. Data shows that using this same formula of fund allocation, Karnataka’s share of funds was cut down from 4.39% to 3.73%. In the same formula, maximum weightage was given to the state’s population and then to the area of the state, making the allocation a bit random. During 2013 also, the allocation of funds became a hot political topic as Nitish Kumar requested UPA to list Bihar under “special category state” to receive more funds and in return he will support the UPA in Bihar elections and Lok Sabha elections. However, with Rajan’s new formula, Bihar lost the tag of “special category state” and it was granted to seven northeastern states, Sikkim, Uttarakhand, Jammu and Kashmir and Himachal Pradesh.

(Source : New backwardness index to determine funds allocation to states)

States get money from the Centre for Development, but implementing “freebies” in the name of “development” and then crying for lack of funds will trigger the Finance Ministry. The pattern of crying for funds is the same amongst all those State Governments implementing freebies for better performance in upcoming elections. Be it Punjab, Tamil Nadu, Kerala, Himachal Pradesh or Karnataka, the story is the same in these states. Gone are the days of dividing the nation by caste or language. So, let the “Tax dividing Nation” debate be buried for once and forever.

📌Analysis of Bills and Acts

📌 Summary of Reports from Government Agencies

📌 Analysis of Election Manifestos