The Special Economic Zone (SEZ) is an enclave within the country’s geographical borders that has more liberal economic laws than the rest of the country. These areas are notified to be located outside the Domestic Tariff Area (DTA). The firms situated in the SEZs can import anything of any value duty-free, but such firms must be positive Net Foreign Exchange Earners. Positive Net Foreign Exchange Earners means that the exports of these firms should exceed the imports. Different forms of special economic zones have been present since the 1930s in the United States.

Before the SEZ was introduced, Asia’s first EPZ (Export Processing Zone) was established at Kandla, Gujarat in 1965. The government set the EPZs intending to initiate infrastructural development with tax holidays in various sectors of the country. The main aim was to establish an export-oriented system, improve the current account deficit, and improve the Balance of Payments situation.

Though the EPZ and SEZ structure was similar, the only difference was that EPZ was only promoting goods, but the SEZ promoted goods and services. The SEZ policy was created to induce rapid economic growth.

The SEZ policy was first announced in April 2000 and a total of 8 EPZs were converted to SEZs in 2000. The Act was established in 2005 and it came into effect (supported by SEZ rules) on 10 Feb 2006.

The SEZs are useful for addressing any market failure or constraints that cannot be addressed in the DTA. If t constraints are addressed with nationwide reforms and incentives, the SEZs would not be necessary. But that isn’t possible as the areas outside the SEZs generate revenue for the government and at the developing stage, the state cannot indulge in nationwide incentive reform. Hence the SEZs are needed to boost exports and growth. Even developed nations have SEZs like the USA, Canada, etc.

The objectives of the SEZ Act 2005 are as follows:

- Increase exports of goods and services.

- Promote both, Domestic and Foreign Investment

- Infrastructure Development

- Employment Generation

- To induce Economic Growth as well as Development.

- Generation of additional economic ability.

Incentives and facilities offered to SEZ (for pushing investments and exports)

- Duty-free import/ domestic procurement of goods for development, operation and maintenance of the SEZ units.

- 100% tax exemption on export income under section 10AA of the Income Tax Act for the first five years, 50% for the next five years and 50% of the ploughed back export profit for the next five years. (Sunset Clause Units will become effective from 01/04/2020)

- Exemption of the Minimum Alternate Tax (MAT) and Dividend Distribution Tax (DDT)

- Tax Rebates. No customs duty, exemption from central sales tax, service tax, excise tax.

- No license is required to import

- SEZ units will have the freedom for subcontracting

- Single window clearances for all state and federal government approvals.

- Exemption in electricity duty and tax on sale of electricity by certain states in India.

But, direct tax benefits are not available for new SEZ units from 31 Mar, 2020.

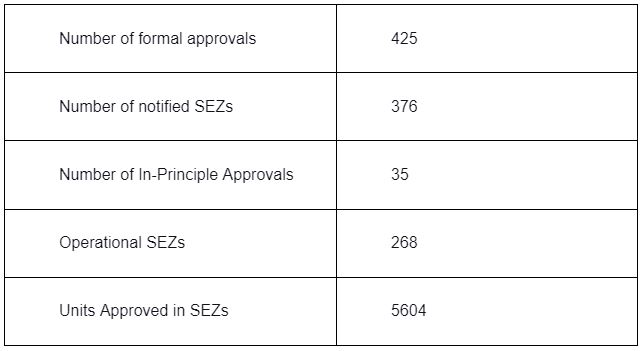

No. of SEZs (as of 27 Jan 2022)

Data on the Improvement of SEZs:

As we can see here, the exports have risen significantly in the SEZs mentioned above from 2018 through 2021, from INR 33.96 billion to INR 694.15 billion in just three years.

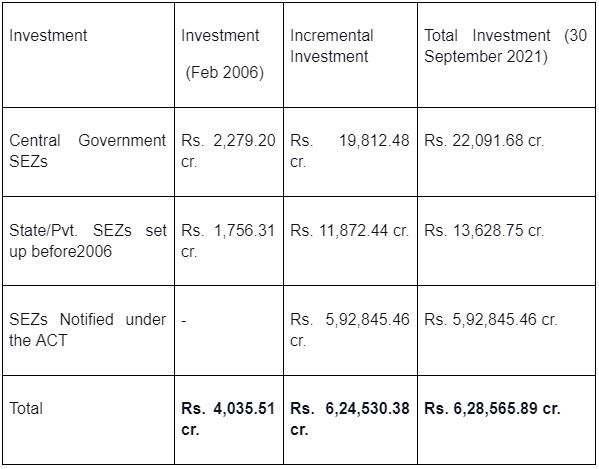

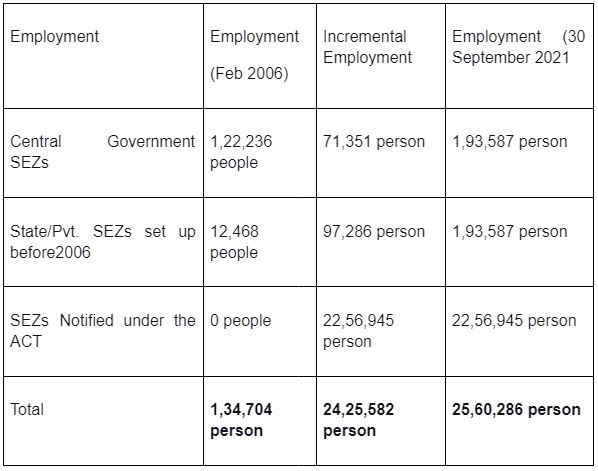

Since 2006 an uptick has been observed in the growth of exports, investments and employment in the SEZ. In Feb 2006, there were only 19 SEZs which later increased to 205 in 2016. During the 2006-2016 decade, the total investment rose from 4000 crores to 4 Lakh crores, and the exports grew from $5 billion to $85 billion. At the end of this decade, the SEZs employed over 15 Lakh people from just 1.3 Lakh people. Considering the tremendous population growth, it is a bit less than expected, but it shows that the numbers will grow in the future, even if it is taking time.

For example, we have this fact sheet as of 27 Jan 2022 from the government website.

As can be seen from the table, investment rose from 4 Lakh Crore to approximately 6.28 Lakh Crore in 2021.

From 15 lakhs in 2016 to 25.6 lakh people were employed in the year 2021.

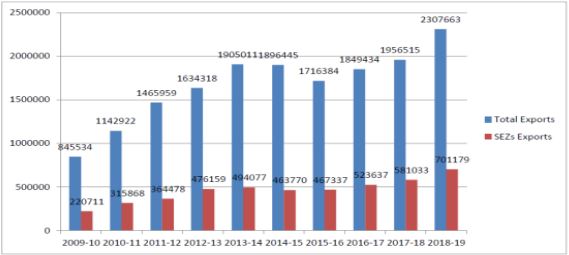

Exports have also risen significantly from $85 billion in 2016 to $92.83 billion in 2021. India’s trade is looking buoyant as its share exceeds 50% of its GDP. The overall exports are poised to reach $400 billion for the first time during FY22.

Total Exports and SEZ exports.

A few issues related to the SEZs.

Even though SEZs have shown a slow yet significant rise in numbers over time, one cannot consider SEZs a success by merely taking only statistics into account. There are other factors to consider as well as social welfare, the fulfillment of the objectives, employment, etc.

1) Well, there have been a few instances where fertile agricultural land has been appropriated for the SEZs. In India, of the almost 5,000 hectares (12,355 acres) of land acquired for SEZs in the last five years, only 362 hectares have been used for their intended purpose, according to SEZ Farmers’ Protection Welfare Association, which filed the petition. “Farmers have been devastated by the loss of their land,” said lawyer Colin Gonsalves, representing the group. The Supreme Court had even sent notices to the seven states about this matter (2017). In 2017 out of 5000 hectares, only 362 hectares were being used for the intended purpose. This also affects food security and farmers lose livelihood. Even E.A.S Sarma, a land rights campaigner who has studied SEZs in the southern state of Andhra Pradesh, said, “We need a review of all SEZs – if the land is not being used, it should be returned to its original owners.”

On 9 Jan 2017, the Supreme Court asked the Centre and several state governments to submit their responses to a PIL seeking the return of 90% of the 4842 hectares of land to farmers, which was acquired to set up SEZs but has been lying unused.

Considering the issue of underutilized land, The Special Economic Zones (Amendment) Bill, 2019, was introduced in Lok Sabha by Mr. Piyush Goyal, Minister of Commerce and Industry, on 24 Jun, 2019. It amends the Special Economic Zones Act, 2005 and replaces an Ordinance that was promulgated on 2 Mar, 2019. The Act provides for the establishment, development and management of Special Economic Zones to promote exports. The bill added two more categories- A trust or any other entity which the government may notify. The setup of trust in the SEZ wasn’t possible earlier, but now it can be set up. Also, if any entity is allowed by the government in the future, it can set up a manufacturing unit. This enabled the Public charitable trusts, private trusts run by big and small corporate houses, etc. to function in the SEZs. 40% of the notified SEZs were non-operational and more than 50% of land notified for SEZ use was lying vacant. Introducing the trusts in the SEZs was a very good move. The trusts are significant contributors to the financial sector. They can result in billions of dollars of new investments, like the setup of an investment trust which will make money by investing money in other companies.

2) Rehabilitation can take a toll on a person’s physical and mental well-being. People from the Paliyapattu village in Chengam block of Thiruvannamalai district in Tamil Nadu have been protesting since the mid of December against the SEZs. The locals are predominantly dependent on the arable land, surviving on agriculture, and they fear a special economic zone (SEZ) could adversely affect their livelihood.

‘The State Industries Promotion Corporation of Tamil Nadu Limited (SIPCOT) campus is to be set up in and around Paliyapattu is said to cover an area of 1,200 acres. Reportedly, 1,000 acres of farmland and residential areas affecting 500 houses will be acquired for the industrial complex’ (News Source 15 Feb 2022). The locals are mainly dependent on agriculture and will bear tremendous losses if they are to be relocated; also the fertile land will be dissipated. (https://www.newsclick.in/Tamil-Nadu-Sees-50-Days-Protest-Against-SEZ-Arable-Land)

3) As there are tax exemptions levied on the SEZs, the government cannot generate revenue through them but has to spend enormous amounts of money on the infrastructure and other facilities. As the SEZs are net forex earners, the exports will be more than the imports and that’s when investments would be induced, encouraging the SEZs to produce more efficiently.

4) Payments for goods sold from SEZ to the domestic market are made in the rupee but for services, it is in dollars. Products sold from SEZ in the domestic market attract customs duties. Domestic firms were required to pay in foreign exchange for services rendered by an SEZ unit, but this was not applicable to the sale of goods made in terms of rupees. An industry expert said that due to this, the government also couldn’t give contracts to SEZ units and the law was an obstacle to the growth of the IT industry in the SEZs. Companies outside the zone have to go through the hassle of changing the rupee to dollar / foreign exchange for the payment. Industry experts say that if SEZ units don’t receive payments in foreign currencies, they are sent notices by the revenue department and denied their SEZ status. However, the commerce ministry is working on simplifying the rules and making the SEZs more attractive. Maybe the government will soon allow payments for services to be in terms of the rupee. We will find this out once the new amendment is implemented.

5) 20,000 hectares of SEZ land and about ten crore sq. feet of built-up land are lying vacant. The land or labour isn’t being used to its full potential. The productivity of the SEZs is much lower than their potential. If this land were to be used to its full potential or even 50% of it right now, it will be conducive to giving the economy a boost and can reach half of the goals and objectives of the SEZ Act.

6) Imposition of the sunset clause, the advantages of the tax benefits are no longer there for the past two years to any unit and have failed to attract new businesses and added the pandemic factor.

The replacement of SEZ Act with the new legislation

One cannot measure the success of the SEZs with only statistics. The progress can be measured by fulfilling the goals and objectives of the program, as the necessities differ from time to time. Successful SEZs can attract large numbers of MNCs and domestic firms, which are conducive to business investments, employment generation, economic growth and the aggregate development of the economy.

While talking about efficiency, China is the biggest exporter and it is due to the SEZs. China has only 6-7 SEZs located in the coastal areas and are huge. The Chinese SEZs are spread over 2000 hectares – 34000 hectares each, looking further into this topic. In China, most zones are plugged into existing local clusters, and as a result, the zones and the local clusters reinforce each other through business linkages. However, the Chinese SEZs were not only exempted from some economic laws but also domestic laws, rules and regulations, flexible labour laws, etc. Separate dedicated centres were set up to attract interest and investment and the SEZs were resistant to internal politics. While India only offers incentives on taxes and exemptions on some economic laws.

However, China’s SEZs did take a hit when fiscal decentralisation and urban biased policies were introduced creating regional disparities. In 1980, for example, China decentralised its fiscal system and separated central and local budgets. This allowed local governments to strengthen their power over local enterprises and keep more of the revenue generated in their region. Fiscal decentralisation encouraged local governments to produce duplicate and inefficient industry structures and limit coordination with other regions, including obstacles to labour mobility and interregional trade (Fleisher & Yang, 2003; Young, 2000). Local budgetary control had also impeded the development of infrastructure (e.g., highways, telecommunication and power), particularly in connecting regions, as some infrastructure was more efficient on a national scale (Zhang & Zou, 2012). For these reasons, evidence suggests that fiscal decentralisation has exacerbated regional inequality. However, they did apply good policies and strategies, which led China to be one of the leading countries concerning SEZs. China has also begun establishing SEZs in Africa to further stimulate the economy. One of the various models that the Chinese government followed was joint management by SEZ partners and government-instituted administrative bodies.

Decentralising or giving the reins to the state or local government had its pitfalls as well as benefits. But in the case of India, partnering with the State Governments is a good move to revamp the Act and give the economy a much-needed boost. To adapt to new conditions and boost the innovation and SEZ units, an amendment for SEZ/ the new legislation was much needed.

Compared to the East Asian countries, India hasn’t been faring well concerning the SEZs and isn’t functioning to their full potential. Direct tax benefits are not available for new units in SEZs from 31 Mar, 2020, and with heavy restrictions/compliances in place for operating in such facilities, demand has become subdued for SEZs, primarily IT parks, and vacancies have started growing. The times were hard during the first two waves of the covid-19 pandemic and SEZs suffered due to that as well. Export drivers were underwhelming for the past 15 years, and as shown in reports, it was borne out of a significant share of sales to local markets or domestic tariff area firms despite the customs duty outgo for the latter (hindubusinessline). Also due to the FTAs between the years 2005-2015 the SEZs lost their appeal as the importers outside SEZs benefitted from zero-rated imports and without being subject to the DTA. Even after the tax holiday was announced for the startups for units and developers in the DTA area, the SEZs weren’t as attractive or exclusive before.

Also, due to limited resources, population explosion, and implementation capacity, developing countries often cannot build the infrastructure and implement policy reforms nationwide all at once. To make the SEZs a success in a new region, a unit of any type must be adapted to the host region’s specific situation. For SEZs to be a long term developmental success, they should be fully coherent with regional industrial policies as well as politics, as even politics plays a major role in shaping the economy.

In the 2022 budget, the Finance Minister, Nirmala Sitharaman announced that the SEZ act will be replaced by new legislation. To boost exports, the legislation will cover all the industrial enclaves and enable states to become partners in the Development and Service Hubs. The government wants to go beyond the export approach and use the SEZ infrastructure for the domestic industries as well. Also, the government will rewrite the law in such a way that the rest of the manufacturing industries don’t compete with the SEZs. The minister also said, “We will also undertake reforms in Customs Administration of SEZs. Henceforth, it shall be fully IT-driven and function on the Customs National Portal, focusing on higher facilitation and only risk-based checks.” The legislation will shift focus from exports toward employment. The changes are expected to factor in the Baba Kalyani panel report. The report recommendations submitted on 18 Nov suggested shifting focus from exports to creating employment hubs and economic activities with supporting infrastructure. It also suggested a Centre-State partnership. B.V. Subrahmanyam said, “The new SEZ act will be WTO compliant and will have a single-window clearance and high-level infrastructure and constitute additional improvements” He also said that the government might even think of putting states on approval bodies either at the state or regional level.

Why is the new legislation essential?

SEZs can create a favourable business environment in a geographical enclave with a more liberal and regulatory framework, efficient services, labour, and infrastructure and it can improve social welfare such as attracting FDI, enhancing export diversification, etc. But to accomplish a goal or to succeed in the smooth functioning of a policy, existing policies should be reformed or replaced taking into consideration specific situations, and comparative advantages of a specific period. If we want to become an export-oriented economy and to gain a surplus in the balance of payments and foreign exchange reserves, there have to be substantive policy changes from time to time.

According to the commerce ministry, exports dipped to rupees 7.65 lakh crore in 2020-21 as against rupees 7.97 lakh crore in 2019-20. But exports from SEZs rose 41.5% to 2.15 trillion rupees from April- to June 2021 which accounted for healthy growth in pharma, engineering, gems and jewellery as per official data. Even the PLI scheme was introduced to stream India’s manufacturing capabilities to work conjointly with the SEZs. Currently, the SEZs account for 20 % of India’s merchandise imports but is that enough? To become a global manufacturing hub and to reach a goal of a $ 5 trillion economy, the government has to make efficient changes to ensure significant growth of the economy. Structural changes do take decades and to achieve economic prosperity, policy changes and replacements are necessary. Being the second-largest populated country in the world, the need for imports is inevitable but to earn a net foreign exchange and sustain the balance of payments, India needs to serve the global economy and emerge as a global manufacturer to improve the standard of living of its people. But, India is blessed with a strategic location and rich, varied resources, so it isn’t impossible to achieve that as long as we work efficiently and implement the right policies. Even India’s coastline is 7,517 km and it is touching 9 states and can be leveraged to create large hubs and environment-friendly industrial clusters. The induction in the global work culture concerning the SEZs has brought about indirect benefits of healthy labour practices, etc.

Coming to the point of partnership with the states for development hubs is a good move. Close coordination between the Central and the State Governments and clarity of roles of each are essential for the smooth functioning of the diversified implemented programs. A legal and regulatory framework is required to ensure the transparency of roles and responsibilities to provide certainty and protection to the developers and investors. This framework will help the zones in finding the right investments pertaining to the conditions of the unit and the area. The smooth running of duties and the clarity of roles will also help establish high business, social and environmental standards and will give a much-needed push to the SEZs in working towards their full potential. Coordination and policy formulation according to the Centre and at the regional level will ensure the possibility of the zones attracting the right investments and setups suitable for the particular/ specific area. This awareness of potential environmental concerns can be looked into minutely to create an environmentally sustainable operation. The coordination of the governments will provide assurity, commitment and additional support for the smooth functioning of a zone or any unit. China, Malaysia and Singapore, implementing policies like this have provided a conducive environment for efficient and effective services and aftercare with a speciality of one-stop shops.

The state-wise policies are also crafted accordingly. As Maharashtra is a leading state in MSMEs, the state policy encourages more entrepreneurs to register/work in the SEZs by giving capital subsidies like a 5% capital equipment subsidy (limited to INR 2.5 million) and various other subsidies, setting up special institutions for the small businesses, etc. (incentives mentioned above in the article). Exemption of import duties, taxes, import licences (UP, mentioned above) will induce the growth of exports as the manufacturer is relieved of all the additional costs of high tech-infra, exports and imports, etc. and can divert all of his/her attention in producing goods/ services efficiently. The uptick observed in the exports will induce the manufacturer/entrepreneur to invest more in production and enjoy a supernormal or a normal profit without worrying too much about the taxes levied by the central government. As the number of exports increases, it attracts investment; be it domestic or foreign. And slowly this helps to expand a business which is very beneficial for a country and helps tackle the issues of budget deficit if invested in the SEZs efficiently (Government/individuals). Right now, we don’t have sufficient data to analyse this new legislation and the revamped state policies, but enabling states to become partners in the Development Hubs, using the SEZ infrastructure for the domestic industries looks promising enough to boost exports, economic growth and the development. Also with the active partnership of the states, we can set up dedicated and specialised centres that may attract a lot of investments.

The government wants to go beyond the export approach and use the SEZ infrastructure for the domestic industries as well. Now granting an equal footing to the domestic industries and using the mechanisms from the zones are effective measures to ensure efficiency all over. Policy incentives to encourage firms to provide training and re-training for employees will improve the efficiency of work and benefit the industry. The reforms will aid the SEZs in the customs administration to withstand any future disruptions in the global supply chain.

Like Korea, we should implement signalling; monthly or even once in three months, a meeting should be conducted to review the progress of the zones and find solutions on how to remove the bottlenecks. This legislation will also pave the way for ‘Aatmanirbhar Bharat’ and will boost import substitution.

Right now rather than focusing on the new setting up new SEZ units, the existing ones should be used to their full capacity. This legislation will enable large and existing industrial enclaves to optimally utilise available infrastructure and mechanisms and enhance export competitiveness. We need world-class infrastructure so that these zones will become manufacturing hubs in the future.

The IT industry is also seeking clarity on the issues such as the impact of the WFH on Tax exemptions. “As the Act reinvents itself, we are working with the Government to make hybrid work a key element so that it accounts for expansion in tier 2 and tier 3 regions as well as flexibility for remote working,” said Dabjani Ghosh, president of IT industry association Nasscom. This clarification is needed for companies to formulate long term plans. Hybrid work will have lower operating costs, and it will help expand into new markets. Even former Infosys COO Pravin Rao said “While the industry is in talks with the Government, to enable SEZand IT-BPM infrastructure in these regions, it is also important to create supporting infrastructure to make the jobs enticing in tier 2 and tier 3 cities and so people don’t have to move to tier 1 cities.” Seconding him on the opinion, this will also solve the issues of overcrowding in the tier 1 cities and will create ample job opportunities and slowly bump up the economy in tier 1 and tier 2 cities.

Ajay Sahai, DG & CEO, Federation of Indian Organisations (FIEO), said SEZ does not have to be restricted to exports. “They are looking to change the SEZ regulation to make it more relevant to current developments. We don’t need to always subject SEZs to export obligations. Global conditions are changing. One has to be fair to domestic industries also. It is a pragmatic and positive move,” he said. Once SEZs are allowed to operate even in the domestic markets, the government has said that the policy will be constructed so that there would be no competition.’

The new legislation will be implemented by 30 Sept, 2022. Overall, this proposed reform will act as a booster dose for the economy and be conducive to the country’s overall employment, economic growth, and development.

📌Analysis of Bills and Acts

📌 Summary of Reports from Government Agencies

📌 Analysis of Election Manifestos