Any expenditure that leads to the creation of assets or a reduction in liabilities comes under the domain of Capital Expenditure (CAPEX). It lays the foundation for an economy’s medium and long-term growth by adding to the existing capital stock and increasing labor productivity. While private entities make capital investments in the economy, they aren’t necessarily targeted toward social welfare and solving macroeconomic problems. This is primarily where public capital expenditure assumes its role. Hence, obtaining an optimal mix of public and private sector expenditure becomes tricky and imperative at the same time. If done in the right way, public investments can help boost economic growth by unlocking production potential via the development of core infrastructure like roads, railways, power generation, etc. Also, it can assist in the creation of a more skilled labor force by investment in the education and health sector. While public capital expenditure is an excellent instrument that can boost demand, private investment, and economic growth, it has its vices.

Inefficiency

Public-funded projects are riddled with inefficiencies due to conflicting political interests, underutilization of resources, lack of motivation among employees, and multiplicity of objectives. Not all public expenditures are made to boost economic growth, and expenditures aimed at social welfare should be assessed accordingly. Although a reasonable composition of varying public outputs (including welfare schemes) must be the goal, appeasement politics often leads to the implementation of high-cost and unproductive social schemes with no real benefits. For example, certain subsidies, that are mere handouts, should be replaced by schemes that lift the living standards of the poor yet are bound to stay due to the fear of political backlash. Many times, prudent policymaking gets sidelined because the political advantages may accrue to future governments. Some governments even choose to abandon projects started by previous governments to safeguard their political interests at the behest of the larger populace. Lobbying by influential groups makes it difficult for governments to make tax reforms and appropriate expenditure cuts in the case of fiscal pressure and resort to reductions in operational and capital costs (IMF pamphlet series 48). Lack of profit motives and accountability (pertaining to no direct stakeholders) leads to underutilization of resources and wasted potential.

Financing Capex

There is an urgent need to narrow the infrastructural gap to ensure the continuous development of the economy. The government, however, cannot finance the required projects on its own. Over and above the earnings in the form of tax and non-tax revenue, governments can borrow money from the public, Central bank, international financial institutions, and other countries. However, all such sources either increase the national debt and interest payments or pose the threat of crowding out private investments. This necessitates private investment in the ambit of infrastructure development projects. A theoretically prudent scheme encourages private-public ownership through asset recycling or monetizing. It allows the state to maintain its ownership of the assets while generating income from them in terms of upfront payments or investment. An example is the Asset Recycling initiative of the Australian government. In 2014, The coalition of Australian governments agreed on the asset recycling initiative put forth by the commonwealth government to reduce the constraints on infrastructure funding within the jurisdictions. While no eligibility criteria were set on the assets to be monetized, the infrastructure projects had to meet predefined standards to qualify for investment. In addition to the funds raised through asset recycling, the federal government set up an Asset recycling fund to pay 15% of the total amount estimated to be invested in a project to the states as an incentive to monetize/sell public assets. One such ambitious scheme by the Indian government is the National monetization Pipeline scheme. The revenue rights of the under-utilized government assets are leased to private firms to ensure upfront payments to the government in the long run. It was announced on 23rd August 2021 to finance the National Infrastructure Pipeline (NIP). In addition to that, asset monetization will also bring in private entities and promote public-private partnerships that can efficiently increase the utilization rates of these assets without transferring their ownership. The project is worth 81 billion US dollars, covering 13 subsectors. The major sectors are Railways, Roads, and power which are estimated at US$ 20.586 billion, US$ 21.6 Billion, and US$ 6.102 billion, respectively. This is a theoretically sound policy, especially since India has a vast public capital stock amounting to $4,548 Billion (IMF, 2015).

In a perfect world with no geographical politics, complementary objectives, conscientious decision making by private entities, absence of conflicting interests, and equal access to information, there would be no problems in implementing NMP. In reality, there are several challenges. Utmost caution must be taken when transferring assets to foreign investors to ensure national security. This led to the blocking of Ausgrid’s sale to Chinese and Hong Kong bidders by Australian Treasurer Scott Morrison in 2016. Agreements governing the PPP (Public-private partnership) must be thorough. They should not put the onus of covering for losses on the government as it will only increase government debts and weaken the public balance sheet in the long run. At the same time, private ownership tends to raise prices, ultimately hurting the end consumer. One such case is the privatization of Chicago’s parking meters. The contact required Chicago to raise parking meter fees by 200 to 800 percent, depending on the area of the city, from 2009 to 2013, which raised parking rates to $7 for two hours of parking in some parts of the city. The contract also requires Chicago to compensate the consortium whenever the city makes decisions that adversely impact the consortium’s ability to collect revenue, such as temporarily closing streets, even for community parades and street fairs.4 The city is also restricted from improving streets with meters, such as adding bike lanes or expanding sidewalks, because these projects might “compete” with the meters and decrease corporate revenues. These restrictions severely limit the city’s future ability to accommodate residents, including bicyclists, pedestrians, and transit users (In the Public Interest, June 2017). Public perception is also critical to the success of NMP, as a strong backlash by strong unions can prove to be a severe roadblock. Especially since the general perception usually associates private ownership with job losses and price hikes. Furthermore, these fears aren’t necessarily unfounded as there have been more layoffs in private entities than public entities. Monetizing assets is no miraculous solution, but it can certainly bring a positive change with due diligence.

Budget 2022-23

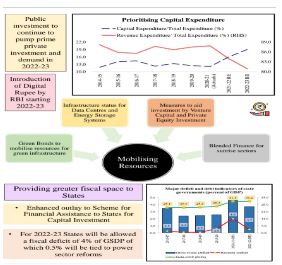

The NDA government announced a 35.4% increase in the effective Capital Expenditure estimated for FY23 to Rs. 7.5 lakh crore from 5.54 lakh crore in FY22. The effective Capital Expenditure, including the grants and aid given to States and Union territories, stands at 10.68 Lakh crores, 4.1% of the GDP. However, this is accompanied by a reduction in the internal and external budgetary resources (IEBR). Nevertheless, the center has continued with its efforts to increase capital outlay in the budget expenditure over the years, which stands at 2.2 times that of 2019-20. It’s concentrated in 8 sectors including Atomic Energies, telecommunications, Defense, police, Housing, urban affairs, Railways, and Road Transport & Highways. It also includes interest-free loans worth Rs. 1 lakh crore which is to be transferred to the states. This move is expected to crowd in private investment that has been sluggish since 2015 and failed to recover due to the pandemic and eventually create new jobs as a byproduct of economic growth.

Capital expenditure increased by 21.71% in FY21 and 34.5% in FY22. Although an increase in capital expenditure is a step in the right direction, its relevance has to be determined by analyzing the budget allocation among different sectors in the economy. Out of the total capital outlay of 7.50 lakh crore, 1.52 lakh crores and 1.37 lakh crores are allocated to the defense sector and railways. While sectors like Telecom, Defense, Environment, transport, housing, and urban affairs saw more significant allocations over the years, Fiscal outlay for strategic sectors like education and health increased negligibly once inflation was accounted for. The innovation, technology development, and deployment under research and development in the Department of Science and Technology, one of the significant growth catalysts, observed a reduction of 130 crores.

The Indian economy undeniably needs an infrastructure boost that can sustain and catalyze growth in the long run. The PM Gati Shakti Yojana, which was allocated 20,000 crores this year, addresses this by connecting seven strategic sectors including Roads, Railways, Airports, Ports, Mass Transport, Waterways, and Logistics infrastructure which can facilitate efficient transport of commodities and people and reduce transport costs. Along with that National Infrastructure Pipeline was announced in 2019. It envisages an investment of 2.1 trillion US Dollars or Rs. 111 lakh crore over five years from FY20 to FY25. This is to be financed by centre, state, and private players in a ratio of 39:39:22. The number of projects to be completed under NIP increased from 6,835 to 7400 in 2021, of which 217 projects.

So far, the Policy regime is indicative of a continued focus on investment and active involvement of the private entities in building the 5 trillion Indian economy. However, there is no denying that regulations on account of public interest have to be in place and the government has to be vigilant to ensure it doesn’t lead to the formation of outright monopolies. But if done right, it could be a game-changer and help develop appropriate infrastructure that caters to development and a better standard of living.

Job Creation

The number of new jobs created between 2019-and 2020 decreased by 16.9 lakhs compared to the previous year, the SBI shows. As per the data reported by the Ministry of Finance, of the workers added in 2019-20, more than 71 percent were in the agriculture sector. Only 2.41 percent of new workers were added in the manufacturing sector compared to 5.65% in 2018-19. In the Indian economy, the above data doesn’t necessarily paint an optimistic picture as the agriculture sector in India suffers through disguised unemployment, i.e., more than the required number of workers are employed in the sector. This only results in lower productivity and brings no change in the aggregate demand. Capex undoubtedly has massive potential for generating jobs by unleashing a cycle of investment and employment through the multiplier effect. A focus on the roads and transport, for example, will not only lead to a better infrastructure but also give a push to the steel and cement industry to create more, resulting in an additional demand. This can increase private CAPEX by raising investor spirits and creating more jobs and demand. However, the government must also simultaneously provide jobs directly to create an instant demand in the economy that will further crowd-in private investment and increase utilization rates by narrowing the gap in demand and supply.

Concerns

For this to materialize, a proper implementation plan and complementary macroeconomic indicators like inflation have to be ensured. While the Reserve Bank’s accommodative stance seems to be catering to growth, it hasn’t been able to make a significant difference in private investments and instead hurt demand by increasing inflation. Efforts in the direction of capacity building on the supply side, stabilize financial markets to ensure that people hold less cash in hand, find alternative ways to raise funds for various government expenditures, simplify logistics, and strengthen redressal mechanisms to avoid cost overruns and project delays must be made. Too much borrowing by the government can increase interest rates and crowd out private investments and create unnecessary pressure by increasing interest payments. Borrowing pressures also rise from the extra-budgetary resources not included in the Union budget. Still, the debts for it are to be paid from the consolidated fund of India.

Therefore, a proper balance between growth objectives and fiscal soundness has to be struck.

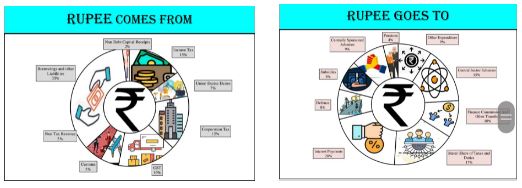

As seen, borrowing is still a huge part of revenue generation while non-debt capital receipts are only 2%. This suggests that the government needs to make more effort to raise funds through divestment, which has been on its agenda for the last few years.

Other than that, decreased welfare expenditure concerns may induce the government to reduce its current estimated capital expenditure. In other words, actual capital expenditure tends to decline, although not much could be said about the same; past instances have proven this true. In FY22 the revised estimates decreased once the expenditure to settle Air India’s debts worth 51,971 crores were accounted for. The implementation can pose even more challenges given reduced allocations towards MNREGA and other welfare schemes.

Way Forward

Capital Expenditure is vital for the economy’s growth in the medium and the long run. Asset creation makes the foundations of an economy strong and provides the much-needed impetus for social development. The multiplier effect of such expenditures helps create additional income in the economy, boost demand, and increase job opportunities. Henceforth, policy thinking is definitely in the right direction; the imperative is to achieve the defined goals. Effective implementation can do wonders for the economy and given the bold stance of the budget, a lack of efficiency can prove to be dangerous.

📌Analysis of Bills and Acts

📌 Summary of Reports from Government Agencies

📌 Analysis of Election Manifestos